Karadeniz kıyısında ağaçlarla kaplı dağların arasında yer alan küçük Ereğli şehri, Erdemir çelik fabrikasının gölgesinde kalıyor. Bu fabrika, kömür kullanarak çelik üreten Türkiye'deki üç izabe fırın çelik fabrikasından biri ve Ereğli’deki insanların hayatını ve sağlığını doğrudan etkiliyor.

Yerel halkın evleri, her birkaç dakikada bir buhar bulutları yayan ve körfezin karşısındaki apartmanları gizleyen bu devasa çelik fabrikasının etrafında bir amfitiyatro gibi konumlanıyor. Coal Action Network (Kömür Eylem Ağı) araştırmacıları, Cumbria’da yeni bir kömür madeninin açılması ve Türkiye’ye kömür sağlaması ihtimali doğunca, Erdemir çelik fabrikası gibi kömür yakan tesislerden etkilenen insanlarla görüşmek için Türkiye’ye geldi.

Coal Action Network’ün Türkiye’yi neden ziyaret ettiği ve Birleşik Krallık’taki kömür madenciliği bağlantıları hakkında daha fazla bilgi için bu sayfayı ziyaret edin.

Türkiye, çelik fabrikaları ve elektrik santrallerinde ithal kömür kullanıyor ve aynı zamanda yerli kömür de çıkarıyor.

Türkiye, küresel olarak sekizinci en büyük çelik üreticisi. 2023 yılında, 33,7 milyon ton çelik üretti ve 21,1 milyon ton hurda metal tüketti. Ülkedeki 30 çelik fabrikasından 27’si elektrik ark fırınlarında hurda metalleri eriterek çelik üretiyor ve ülkenin çelik üretiminin %72’sini sağlıyor. Çelik üretim sürecinde kok kömürüne dönüştürülmüş kömür kullanılan üç izabe fırın ve ısı sağlamak için kömür kullanan birçok elektrik ark fırınları bulunuyor. Bu kömür büyük ölçüde ithal ediliyor. Rusya, Türkiye'nin kömür ithalatının %73'ünü sağlıyor, kalan kısmının çoğu ise Kolombiya’dan geliyor.

Elektrik ark fırınları büyük miktarda elektrik tüketiyor ve Türkiye'de bu elektriğin büyük bir kısmı elektrik şebekesi üzerinden kömürden sağlanıyor. Türkiye’de bir elektrik ark ocağı, kendi kömürlü elektrik santraline sahip. Türkiye'nin elektriğinin %35’i kömürden sağlanıyor (2022 yılı verisi). Türkiye, 2023 yılında 18 milyon ton çelik ithal etti ve 12,7 milyon ton çelik ihraç etti. Şu anda hurda metal eritmek için kömür kullanan 20’den fazla elektrik ark fırını çelik tesisi var. Çelik, Türkiye'nin üçüncü en büyük ihracat sektörü.

Türkiye, Rus kömürünün en büyük beş ithalatçısından biri. Birçok ülke, 2022'de Ukrayna’nın işgalini takiben, yaptırımlar kapsamında Rus kömürü almayı durdurdu. Bunlar arasında Birleşik Krallık, AB üyesi ülkeler ve ABD de bulunuyor.

Enerji ve Temiz Hava Araştırma Merkezi’nden (CREA) Vaibhav Raghunandan, "Türkiye'nin artan Rus kömürü bağımlılığı (ve diğer fosil yakıtlar) giderek daha değişken hale gelen bir tedarikçiye bağımlı olması anlamına geliyor. Rus kömür sektörü Kremlin için büyük bir gelir kaynağı ve Rusya Enerji Bakanlığı, 2035 yılına kadar küresel kömür pazarının %25’ini elde etme hedefi koydu. Kömürden elde edilen vergiler, Federal Bütçe’nin önemli bir parçasını oluşturuyor. İşgalden bu yana Türkiye – bir NATO ülkesi – Rus kömürü için 8,2 milyar avro ödedi, bu da Rusya'nın Ukrayna'yı işgalini etkili bir şekilde finanse ediyor" dedi.

İşgalden sonra Türkiye, Rus kömüründeki pazar payını artırdı. Türkiye’nin ithalatı, Rusya’nın toplam kömür ihracatının %13’ünü oluşturuyor. 2024’ün ilk üç çeyreğinde Türkiye, 15,7 milyon ton Rus kömürü ithal etti; bu da Türkiye’nin toplam kömür ithalatının %49’unu oluşturuyor (değeri 1,66 milyar avro). Bu, işgal öncesi dönemin aynı dönemine kıyasla %82’lik bir artış anlamına geliyor.

Ayrıca, Rus kömür madenciliği sektörü kültürel soykırım, çevresel yıkım ve hava kirliliği sorunlarına neden oluyor. Bu konular, Coal Action Network ve Fern'in "Sibirya'da Yavaş Ölüm" adlı raporunda ayrıntılı olarak ele alınıyor.

Dünya Sağlık Örgütü'ne göre, hava kirliliği, dünya genelinde ve Türkiye’de halk sağlığı için en büyük çevresel tehdit. Çelik fabrikalarından ve elektrik santrallerinden kömür tüketimi sırasında salınan sağlığa zararlı dört ana kirletici bulunuyor: Sülfür dioksit (SO2); partikül madde – PM10 ve daha küçük PM2.5; azot oksitler (NOX) ve cıva.

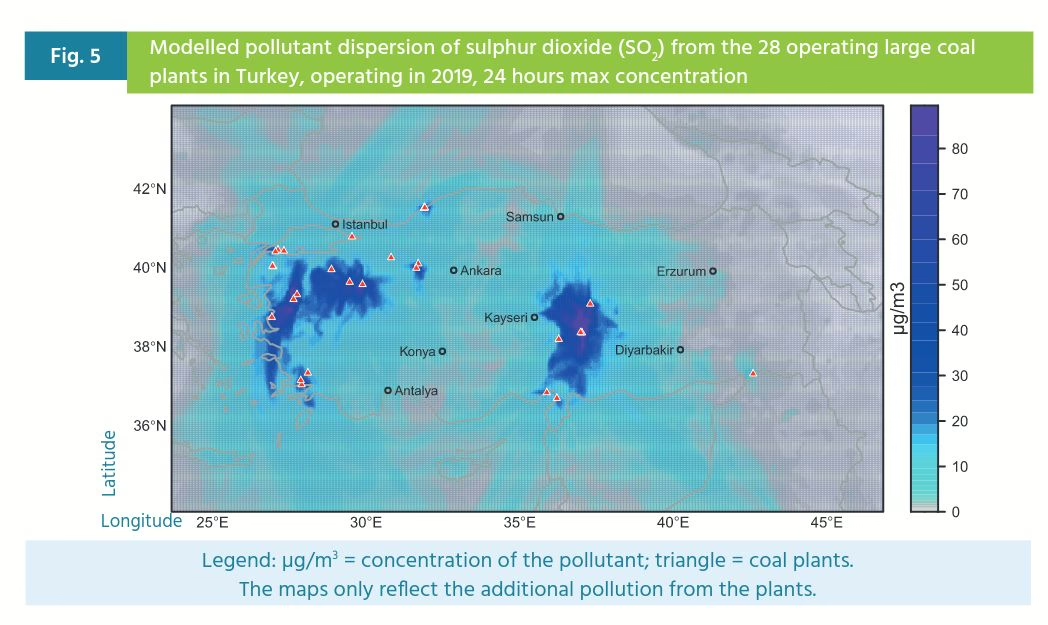

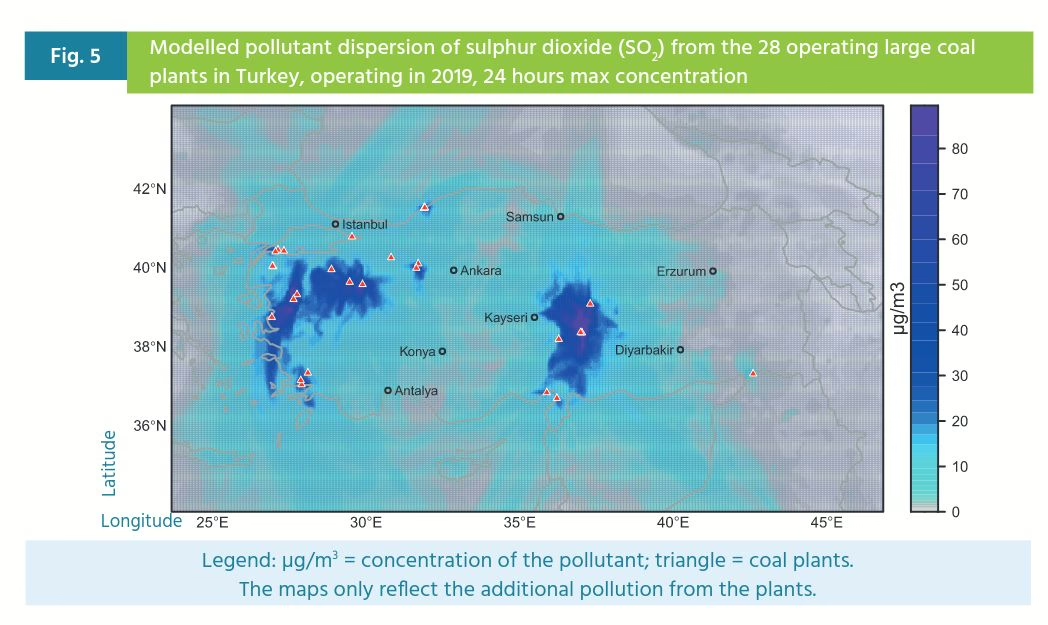

Yüksek sülfür içerikli kömürün yanmasıyla oluşan SO2 solunduğunda, felç, kalp hastalığı, astım, akciğer kanseri ve ölüm gibi sağlık sorunları riskini artırıyor. Solunması son derece toksik olarak sınıflandırılıyor. Yüksek konsantrasyona bir kez bile maruz kalma, astım gibi kalıcı bir duruma yol açabilir. Türkiye’de SO2 emisyonları 2019 yılında %14 artış göstererek, emisyonların arttığı nadir ülkelerden biri oldu. Türkiye’de kömür bazlı enerji üretimi, SO2 emisyonlarının en büyük kaynağı olmaya devam ediyor.

Ereğli’de, Erdemir çelik fabrikasının çevresinde yaşayan halk, sağlıklarına ilişkin üniversitelerin yaptıkları çalışmaların genellikle hükümet tarafından ört bas edildiğini söyledi. Ancak Ereğli'deki multipl skleroz (MS) oranlarını, 40 km uzakta temiz bir kent olan Devrek ile karşılaştıran bir çalışma, “bir demir çelik fabrikasının bulunduğu bölgedeki [Ereğli] MS prevalans oranının kırsal bir şehirle [Devrek] karşılaştırıldığında iki kattan fazla olduğunu” gösteriyor. Bu da hava kirliliğinin MS hastalığının olası bir nedeni olabileceği hipotezini destekliyor. Yerel halk, çelik fabrikasının havayı kirlettiği ve sağlıklarını bozduğu konusunda ikna olmuş durumda.

Karadeniz, Ereğli ve Alaplı Çevre Gönüllüleri lideri Çetin Yılmaz, Erdemir’de yaşanan sorunları tartışmak üzere Coal Action Network ile görüşmek isteyen 15 endişeli vatandaşı bir araya getirdi. Bu kişiler, çelik fabrikaları ile yerel halkın sağlığının bozulması arasında bağlantılar olduğunu gösteren ancak hükümet tarafından gizlenen bilimsel çalışmalardan yakınıyorlar.

Çetin, “Şirket [Eren Energy] birçok insanda kansere neden oldu, çalışanlarının sendikalaşma hakkını tanımıyor; sendikalaşmak isteyen işçileri işten çıkardı; Çatalağzı’nı nefes alınamaz bir hale getirdi; balık üreme alanlarını külle doldurdu; yılda 2 milyon ton ithal kömür yakıyor ve bölgemizde insanlara ve doğaya en büyük zararı veriyor” diyor.

Erdemir çelik fabrikasında 18 yıldır çalışan bir işçi, gırtlak kanseri olduğunu anlatırken bu sesinden duyulabiliyordu. Yerel halkın %50’sinin sağlığının çelik fabrikasından etkilendiğini düşünüyorlar. Bir öğretmen, her sınıfında yaklaşık 10 çocuğun kötü hava kalitesi nedeniyle solunum sorunları yaşadığını anlattı.

Yerel siyasi temsilci Coal Action Network’e, “Buradaki çoğu kişi madenlerde veya çelik fabrikasında çalışıyor, herkes hava kirliliğinin kansere ve solunum zorluklarına neden olduğunu biliyor. Çalışanlar bu konuda bir şey yapacak durumda değil çünkü para kazanmaları gerekiyor ve işlerini kaybetme tehlikesi yaşıyorlar” dedi.

Erdemir ve İsdemir izabe fırınlarının sahibi olan OYAK, karbonsuzlaşmak için yedi farklı yöntem kullanacağını belirtiyor. Ancak sözde Net Sıfır Yol Haritası, emisyonları azaltma amaçlı potansiyel seçeneklerin bir listesi gibi duruyor; gerçek bir plan barındırmaktan oldukça uzak.

İsdemir’deki hava kirliliği ve sağlık sorunlarının Erdemir’deki durumla benzer olması muhtemel. Türkiye’nin izabe fırın çelik üretimindeki CO2 yoğunluğu, Avrupa, ABD ve Güney Kore’de üretilen çeliğin emisyonları ile kıyaslandığında daha yüksek düzeyde.

Türkiye'deki çelik üretim değer zincirinde çevre, kamu ve iş sağlığı düzenlemelerine uyum konusunda uzun süredir aksaklıklar yaşanıyor.

Avrupa’nın doğu sınırında yer alan Türkiye’nin, 2024'te Avrupa’nın en büyük kömürle çalışan elektrik üreticisi olan Almanya’yı geride bırakması bekleniyor. Türkiye, 2022 yılında açılan Hunutlu Termik Santrali gibi yeni kömürlü termik santralleri açmaya devam ediyor. Türkiye’de 34 kömürlü termik santral var; bunlardan 10'u taş kömürü kullanırken geri kalanı daha düşük enerji yoğunluğuna sahip, daha düşük kaliteli linyit kömürünü kullanıyor. Kömürle çalışan iki izabe fırının ayrıca elektrik sağlayan kömür santralleri de bulunuyor.

Türkiye'nin elektrik tüketimi son yirmi yılda üç katına çıktı; bu artış büyük ölçüde kömür ve gaz üretimindeki hızlı büyümeye dayanıyor.

Ereğli’nin yanı sıra, Coal Action Network, Zonguldak ilçesinde Muslu yakınlarındaki ZETES III ve IV ile Çatalağzı isimli üç kömürlü elektrik santralini ziyaret etti.

Zonguldak, 2020 yılında covid-19 önlemleri kapsamında Türkiye genelinde hafta sonu sokağa çıkma yasaklarına büyük şehirlere ek olarak dahil edilen tek bölgeydi. Bu karar, düşük hava kalitesine bağlı olarak önceden yüksek oranlarda görülen kronik solunum yolu hastalıkları nedeniyle alındı. Yerel yetkililere göre, bölge nüfusunun yaklaşık %60’ının belirli bir dereceye kadar solunum semptomları gösterdiği tahmin ediliyor ve 2010 ile 2020 arasında ölüm oranları neredeyse iki katına çıkmış durumda. Düşük hava kalitesi, çelik fabrikaları, kömür madenleri ve taş kömürü santrallerinden yayılan yüksek düzeydeki PM2.5 ve SO2 kirleticilerinden kaynaklanıyor.

Türkiye’de sadece kömürden elektrik üretiminin sağlık maliyetleri, 26,07 - 53,60 milyar Türk Lirası (2,86 - 5,88 milyar €) arasında olup, bu tutar Türkiye’nin yıllık sağlık harcamalarının %13 - %27’sine eşit.

Türkiye'nin çelik fabrikaları ve elektrik santralleri ile ilgili olarak AB’nin geri kalanından önemli ölçüde ayrıldığı nokta, hava kalitesi standartlarına uyum ve bu standartların uygulanması. “AB üye ülkeleri, tesis düzeyindeki emisyonları kamuya açık bir veri tabanına bildirmekle yasal olarak yükümlüyken [...] Türkiye elektrik santrali veya sektörel emisyon verilerini paylaşmıyor. Bunun yerine, elektrik üretimi ve ısıtma sektörüne ait birleşik verileri raporluyor.” Bu durum verileri gizliyor. Ayrıca Türkiye, sülfür emisyonlarını sınırlama ve diğer kirleticilerle ilgili iş birliği yapma amacı taşıyan üç önemli teknik anlaşmayı imzalamadı. Bunlar; Sülfür Emisyonlarının Azaltılması üzerine 1985 Helsinki Protokolü, Sülfür Emisyonlarının Daha Fazla Azaltılması üzerine 1994 Oslo Protokolü ve Asitlenme, Ötrofikasyon ve Yüzeyde Ozonu Azaltma üzerine 1999 Göteborg Protokolü’dür. HEAL, “Şeffaflık eksikliği, ülkede hava kalitesini ve sağlığı iyileştirme konusunda rasyonel ve bilgiye dayalı bir tartışmayı engelliyor” diye belirtiyor. Yerel halk ve ekosistemler, sonuçlarıyla baş başa kalıyor.

Son yirmi yılda Türkiye’de özelleştirilen elektrik santrallerinin birçoğu SOx filtre teknolojisini kullanmıyor ve bunlar Türkiye’nin artan SOx kirliliğine başlıca katkı sunanlardan.

Coal Action Network ile görüşen herkes, Türkiye’nin kömür tüketen tesislerinin hava kalitesi üzerindeki etkileri hakkında endişe duyuyor. Karadeniz yakınlarında, Zonguldak’ta üç kömürlü termik santraline yakın yaşayan bir sakin, “İnsanlar belirli dönemlerde santrallerdeki hava kirliliği filtrelerinin düzgün çalışmadığına inanıyor. Yılda 250 gün boyunca kirlilik, hükümetin kabul edilebilir standartlarının üzerinde oluyor” diyor.

Çelik fabrikalarını veya kömürlü termik santralleri ile yaşayan yerel sakinlerin genel anlatımı, kötü hava kalitesi, daha yüksek oranlarda solunum hastalıkları, çeşitli kanser türleri ve bitki ve bitki örtüsünün ölümü sonucunda yerel halkın yiyecek yetiştirememesi yönündeydi.

2021’de Türkiye, elektrik santralleri ve çelik fabrikaları için 36 milyon ton kömür ithal etti ve çoğunlukla çelik yapımında kullanılmayan yerli linyit kömürünü de tüketti. Türkiye Kömür İşletmeleri, kömür ithalatındaki en büyük artışın elektrik üretim talebinden kaynaklanacağını vurguluyor ve bu eğilimin devam edeceğini öngörüyor. Cumhurbaşkan Erdoğan, ülkenin 2053’e kadar karbonsuzlaşacağını söylüyor, ancak izabe fırınları karbon azaltım stratejilerine dahil etmeye yönelik anlamlı bir yol haritası bulunmuyor.

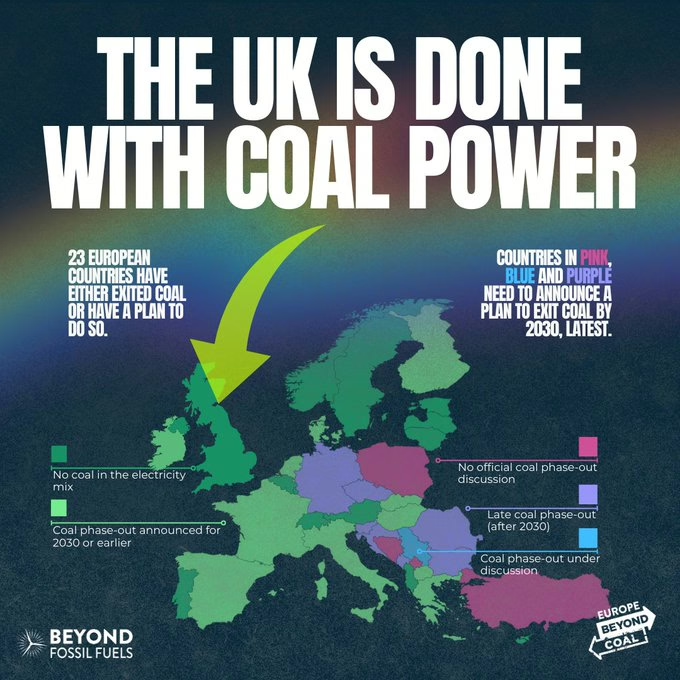

Ekosfer'den Barış Eceçelik, “Türkiye, Avrupa'da kömürü aşamalı olarak kaldırmak için bir tarih belirlememiş birkaç ülkeden biri. Geçen yıl, Türkiye tarihinde ilk kez, ithal kömür elektrik üretiminde en önde gelen enerji kaynağı haline geldi. Türkiye, rüzgar, güneş ve biyokütle dahil olmak üzere yenilenebilir enerji kaynakları için önemli bir potansiyele sahip. Ancak ciddi bir iklim hedefinin ve kömür kullanımına karşı önlemlerin olmaması hava kirliliğine ve yüksek düzeyde enerji bağımlılığına yol açtı. İthal kömür, iklim değişikliği veya hava kirliliği sorunlarına bir çözüm değil” diyor.

Kömürlü termik santrallerinin çevresindeki kirlilik sorunları sadece hava kalitesini etkilemekle kalmıyor. Aynı zamanda Karadeniz üzerinde büyük bir etkiye sahip. Elektrik santrallerinde soğutma işlemlerinde kullanılan suyun daha sonra denize geri verilmesi nedeniyle, santralin çevresindeki suyun diğer yerlere kıyasla 4 derece daha sıcak olduğu bildiriliyor. Yerel halk, santrallerden salınan ağır metaller ve diğer toksinlerden kaynaklanan bir tabakanın su yüzeyinde görüldüğünü bildiriyor. Yüksek sülfür içeriğine sahip kömürün yakılması, asit yağmuru üreterek göl ve akarsuları asitleştiriyor. Karadenizli balıkçılar, santrallerin balık üreme alanlarına zarar verdiğini ve yakaladıkları balık miktarını azalttığını belirtiyor. Bu balıklar İstanbul ve Ankara’ya satılıyor.

Kömür, Türkiye’de tartışmalı bir konu. Mevcut kömür tesislerine yakın yaşayan insanlar güvenli iş imkanları isterken, yeni madenlere karşı protestolar da var. 2013 yılında bir linyit kömür madeninin önerilen açılışı protestoların ardından iptal edildi. Maden kazaları ise oldukça yaygın; 2022 Ekim ayında Karadeniz yakınlarında derin bir madende 41 kişi öldü ve 11 kişi ağır yaralandı.

Kokurdan (resmi adı: Körpeoğlu) adlı yüksek dağ köyünde, kömür külü ve atık döküm alanı, yerleşim havuzunun çevresindeki yoğun ağaçlara toz bulutları saçıyor. ZETES elektrik santrallerinin külü ve hava filtrelerinden çıkan kirletici maddeler açık bir alanda biriktiriliyor. Coal Action Network, köyü, bitki örtüsünün, evlerin ve yolların yoğun bir yağıştan sonra tozdan temizlendiği bir zamanda ziyaret etti; ancak ZETES kömürlü termik santrallerinden gelen atıklar, bu insanların ciğerlerinde, evlerinde ve ekinlerinde birikiyor.

Köylüler, Coal Action Network’e, kömür tesislerinin bu tür kirlenmelere neden olduğu bir bölgeyi neden ziyaret etmek istediğimizi sordu. Yolda geçerken bir kadın, “Buradan nefret ediyorum, çünkü burası kirlilik nedeniyle yaşanmaz halde. Hava kuru olduğunda toz her şeyi kaplıyor” dedi. Bu köyde insanlar, iş imkanları yüzünden verilen zararın buna değdiğine ikna olmuyor. Yerel halk kömürlü termik santralleri hakkında iyi bir şey söylemiyor; yalnızca sağlık üzerindeki olumsuz etkilerden, ayrıca karaciğer kanseri ve mide kanseri gibi hastalıklardan bahsediyor.

En temel hava kirliliği kontrolleri bile uygulanmıyor – kömür taşıyan kamyonlar, tozun güzergâh boyunca yayılmasını önlemek için kapatılmıyor; bu önlem uzun zaman önce Birleşik Krallık'ta standart hale gelmişti. ZETES elektrik santrallerinin konveyör bantlarının altından kamuya açık yollar geçiyor.

PM10 olarak bilinen ince toz partiküllerini izleme cihazları çelik fabrikalarının çevresinde çalışmıyor. PM2.5, akciğerlere nüfuz edebilen ve hatta kan dolaşımına girerek astım, kalp krizi ve bronşit gibi kronik hastalıklara yol açabilen daha ince bir partikül. Ereğli çevresinde PM2.5 ölçümü yapılmıyor.

Coal Action Network’ün Karadeniz kıyısında dört kömür tesisini ziyaretinde, kömür yakmanın insan ve çevre üzerindeki maliyetlerinin yüksek olduğu görüldü. Sağlık, yerel çevre ve iklim değişikliği sorunları yeterince ele alınmıyor, ancak kömür tesislerine yakın yaşayan topluluklar bu durumun iyileştirilmesini talep ediyor.

Coal Action Network (Kömür Eylem Ağı) araştırmacıları, 2024 yılı baharında, ithal kömürün Türkiye'deki çelik fabrikaları ve kömürlü termik santralleri yakınlarında yaşayan topluluklar üzerindeki etkilerini yerinde görmek için Türkiye'yi ziyaret etti.

O dönemde, Birleşik Krallık’ın Cumbria bölgesindeki Whitehaven yakınlarında, Batı Cumbria Mining Ltd’nin deniz altındaki bir kömür madeninden, 2049 yılına kadar yılda 2,78 milyon ton kömür çıkarmak için aldığı planlama izni bulunuyordu.

Whitehaven'den çıkarılacak kömürün büyük kısmı ihracat için planlanmıştı. Ancak Whitehaven kömürü yüksek sülfür içerdiği için, Avrupa Birliği ülkeleri bu kömürü hava kirliliği standartları sebebiyle izabe fırınlarında kullanamıyor. Birleşik Krallık’taki izabe fırınlar ise hurda çeliği geri dönüştürmek amacıyla elektrik ark fırınlarıyla değiştirilecek.

Bu nedenle, Batı Cumbria Mining Ltd tarafından potansiyel pazar olarak listelenen ülkeler arasında, yalnızca Türkiye uygun bir seçenek olarak görülüyordu.

Whitehaven kömürü, kok kömür olarak değerlendiriliyor olsa da, nihai kullanım amacı kömürü kimin aldığına bağlı olacaktı. Kok kömür, genellikle elektrik santrallerinin kullanımı için fazla pahalı, ancak yüksek sülfür içeriği fiyatını düşürdüğünden, Cumbria kömürü Türkiye’deki elektrik santralleri tarafından satın alınabilirdi.

Türkiye ziyaretimizden kısa bir süre sonra Birleşik Krallık’ta bir Genel Seçim oldu. Aralık 2022'de Whitehaven'deki yeni kömür madenini onaylamış olan Muhafazakar Parti hükümeti, İşçi Partisi’nin zaferiyle görevden alındı.

Yeni İşçi Partisi hükümeti kurulduktan bir ay sonra, South Lakes Action on Climate Change ve Friends of the Earth tarafından, önceki Muhafazakâr Hükümetin kömür madenini onaylama kararına karşı açılan bir dava görüldü. Yeni İşçi Partisi hükümeti, önceki hükümetin kararını savunmamaya karar verdi. Eylül 2024'te hakim, kömür madeni için verilen planlama iznini iptal etti.

Bu önemli karar, ardından Kömür İdaresi’nin kömür madeni için yapılan lisans başvurusunu reddetmesiyle pekişti. İşçi Hükümeti'nin başvuruya dair nihai bir kararı henüz açıklanmadı, ancak gerekli izinlerin alınmasının artık pek mümkün olmadığı düşünülüyor.

Türkiye’nin kömür kullanımıyla ilgili bu makaleyi, araştırmamız sırasında bizlere cömertçe yardım eden Türkiye halkına teşekkür etmek amacıyla yayınlıyoruz, ancak bu artık Birleşik Krallık'taki aktif bir kampanyanın parçası değil.

Türkçe için bu web sayfasına bakın.

The small city of Ereğli nestles between tree covered mountains and Turkey’s Black Sea coast. The city is dominated by the Erdemir steelworks. It is one of three blast furnace steelworks in Turkey, using coal to produce steel. Erdemir is a mighty presence in the lives and lungs of the people living nearby.

Local people’s homes sit in an amphitheatre surrounding the vast steelworks, which sends plumes of steam into the air every few minutes that shimmers and obscures apartment blocks across the bay. Investigators from Coal Action Network travelled to Turkey to speak with people currently affected by Turkish coal burning facilities, like the Erdemir steelworks, when it looked possible that a new coal mine would open in Cumbria and supply coal to Turkey, perpetuating the local populations’ air pollution issues. For more information on why Coal Action Network visited Turkey and links to UK coal mining, see this page.

Turkey uses imported coal in its steelworks and power stations, as well as mining domestically.

Turkey is the 8th biggest steel producer globally. In 2023, it produced a massive 33.7 million tonnes of steel and consumed 21.1 million tonnes of scrap metal, according to World Steel Association. 27 of the 30 steelworks in the country produced steel by melting down scrap metal produced in Electric Arc Furnaces (EAF), producing 72% of the country’s steel output. There are three blast furnaces that use coal, converted into coke, in the steel making process, and many of the EAFs use coal to provide heat. This coal is largely imported. Russia supplies 73% of Turkey’s coal imports, and Colombia the bulk of the remainder.

EAFs consume large amounts of electricity. In Turkey, much of this electricity comes from coal through the power grid. One Turkish EAF has its own coal power station. Coal power supplied 35% of Turkey’s electricity in 2022. Turkey both imports and exports large quantities of steel (18 million tonnes and 12.7 million tonnes respectively, in 2023). More than 20 of the EAF steel facilities currently use coal to melt scrap metal. Steel is the country’s third largest export sector.

Turkey is one of the top five importers of Russian coal. Many countries, including the UK, EU member states and USA stopped buying Russian coal, as part of sanctions following the country’s invasion of Ukraine in 2022.

Vaibhav Raghunandan, from Centre for Research on Energy and Clean Air (CREA) says, “Turkeyʼs increased reliance on Russian coal (and indeed other fossil fuels) is effectively tying it down to an increasingly volatile supplier who controls their market. The Russian coal sector is a huge source of revenue for the Kremlin and the Energy Ministry had set targets of attaining 25% of the global coal market by 2035. Taxes from coal constitute a significant part of the Federal Budget. Since the invasion, Turkey — A NATO country — has paid EUR 8.2 bn for Russian coal, which effectively finances Russiaʼs invasion of Ukraine.”

Since the invasion Turkey has increased its market share of Russian coal, Turkey’s imports constitute 13% of Russiaʼs total coal exports. In the first three quarters of 2024, Turkey has imported 15.7 million tonnes of Russian coal, making up 49% of Turkey’s total coal imports (valued at EUR 1.66 billion). This is an 82% increase when compared to the same period in the year prior to the invasion.

Additionally, the Russian coal mining industry causes cultural genocide, environmental destruction and air pollution issues, detailed in Coal Action Network and Fern’s report, Slow Death in Siberia.

According to the World Health Organization, air pollution is the largest environmental threat to people’s health across the globe, including in Turkey. There are four main health harming pollutants released in coal consumption from steelworks and power stations: Sulphur dioxide (SO2); particulate matter – PM10 and the smaller PM2.5; nitrogen oxides (NOX) and mercury.

Breathing SO2, which is produced on combustion of high sulphur coal, increases the risk of health conditions – including stroke, heart disease, asthma, lung cancer and death. It is classified as very toxic when inhaled. Even a single exposure to a high concentration can cause a long-lasting condition like asthma. SO2 emissions rose by 14% in Turkey in 2019, one of the few countries in which emissions increased in that year. Coal-based energy production remains the major source of SO2 emissions in Turkey.

Local people in Ereğli, the city surrounding the Erdemir blast furnace steelworks, told Coal Action Network that university studies into their health are normally suppressed by government. However, in a study looking at the incidence of multiple sclerosis (MS) in populations in Ereğli compared to Devrek, which is a rural and clean city located 40 km away from Ereğli, “indicate a more than double MS prevalence rate in the area home to an iron and steel factory [Ereğli] when compared to the rural city [Devrek]. This supports the hypothesis that air pollution may be a possible etiological [Pertaining to, or inquiring into, causes] factor in MS.” Local people take no persuading that the air is contaminated by the steelworks and damaging their health.

Çetin Yılmaz, leader of Black Sea, Ereğli and Alaplı Environmental Volunteers, brought together 15 concerned citizens from Erdemir to talk with Coal Action Network about the impacts they face in the town surrounding the steelworks. They bemoan the scientific studies which show links between the steelworks and the diminishing health of the local population, but which are suppressed by the Government.

Çetin says, “The company [Eren Energy] has caused cancer in many people, it does not recognize the right of their employees to unionize in its facilities; it has fired workers who want to be unionized; it has made Çatalagzı into a breathless state; it has filled fish breeding grounds with ash; it burns 2 million tons of imported coal every year and caused the greatest damage to humans and nature in our region.”

A worker, who has worked at the Erdemir steelworks for 18 years, explained how he got throat cancer, which could be heard affecting his voice when we met him. Local people think 50% of the population’s health is affected by the steelworks. A teacher present recalled how in each of his classes around 10 children will have breathing issues, caused by the poor quality air.

The local political representative told Coal Action Network, “Most people here work in mines or in the steel plant, everyone knows that the air pollution causes cancer and breathing difficulties. The workers aren’t in a position to do anything about it as they have to earn money and would lose their employment, as well as their health.”

OYAK, the company which owns Erdemir and İsdemir blast furnaces, says it will use seven different methods to decarbonise. Its so called Net Zero Roadmap reads more like a list of potential options to reduce emissions and does nothing to resemble an actual plan.

Air pollution and health problems at İsdemir are likely to mimic those at Erdemir. Turkey’s CO2 intensity for the blast furnace steel production exceeds the comparable emissions for steel produced in Europe, the USA, and South Korea.

There have been persistent shortcomings in compliance with environmental, public, and occupational health regulations across the steel production value chain in Turkey.

Sitting at the eastern edge of Europe, Turkey is expected to surpass Germany as Europe's largest coal-fired electricity generator in 2024. Turkey is still opening new coal power stations, such as Hunutlu Thermal Power Plant opened in 2022. Turkey has 34 coal fired power stations, 10 use hard coal and the remainder use lignite, a less energy dense, poorer quality coal that is burnt close to its source. Two of the blast furnaces using coal also have coal power stations providing their electric.

Turkey’s electricity consumption has tripled in the last two decades, which has been underpinned by rapid growth in coal and gas generation.

As well as Ereğli, Coal Action Network visited three coal fired power stations near Muslu, called ZETES III and IV and Çatalağzı. All of the sites are within the district of Zonguldak.

Zonguldak was the only non-metropolitan district included in Turkey-wide weekend curfews for covid-19 reduction measures in 2020. This was due to pre-existing high rates of chronic respiratory diseases caused by poor air quality. According to local officials, it’s estimated that as much as 60% of the population displays some degree of respiratory symptoms, with mortality rates almost doubling between 2010 and 2020. The low air quality is caused by elevated levels of PM2.5 and SO2 pollutants from steelworks, coal mines and hard coal power plants.

The health costs from coal power generation in Turkey alone, are 26.07 - 53.60 billion Turkish Lire (2.86 - 5.88 billion €), which is equivalent to 13 - 27% of Turkey’s annual health expenditure.

Where Turkey significantly deviates from the rest of the EU in relation to steelworks and power stations is in the compliance and enforcement of air quality standards. As a report by Health and Environment Alliance (HEAL) shows, “While EU member states are legally required to report emissions at plant level to a publicly accessible database [...] Turkey does not share power plant or sectoral emission data. Instead, it reports merged data for electricity generation and the heating sector” This obscures the data. Furthermore, Turkey has not signed other important technical agreements to limit, and cooperate on, other pollutants. This includes three protocols on sulphur emissions (The 1985 Helsinki Protocol on the Reduction of Sulphur Emissions, the 1994 Oslo Protocol on Further Reduction of Sulphur Emissions, and the 1999 Gothenburg Protocol to Abate Acidification, Eutrophication and Ground-level ozone.). As HEAL states, “The lack of transparency prevents a rational and informed debate about improving air quality and health in the country.” Local people and ecosystems are left to deal with the consequences.

In the last 20 years, Turkey’s power plants that have been privatised and many do not use filter technology for SOx. They are the major contributor to Turkey’s increasing SOx pollution.

Everyone who spoke to Coal Action Network is worried about the air quality impacts of Turkey’s coal consuming plants. A resident living near three coal power stations on the Black Sea, near Zonguldak, says, “people believe that in some periods the air pollution filters on the plants are not working properly. Habitually, we have 250 days in a year the pollution is higher than the government’s acceptable standards.”

The consistent narrative from the residents overlooking either the steelworks or the coal power stations was one of poor air quality, resulting in higher rates of respiratory illness, cancers of various sorts, and death of plants and vegetation leading to an inability of local people to grow food.

In 2021, Turkey imported 36 million tonnes of coal for its power stations and steelworks, as well as using its domestically mined coal, which is mainly lignite, not used in steel-making. Turkish Coal Enterprises emphasises that the most significant increase in coal imports will come from the demand for electricity generation, and estimates that this trend will continue. Although President Erdoğan says the country will decarbonise by 2053 there is no meaningful road map to bring the blast furnaces into relevant carbon reduction strategies.

Barış Eceçelik from Ekosfer states, “Turkey is one of the few countries in Europe that has not set a date for the phase-out of coal. Last year, for the first time in the history of Turkey, imported coal became the leading energy source in electricity generation. Turkey has significant potential for renewable energy sources, including wind, solar, and biomass. However, the lack of a serious climate target and measures against coal usage has led to air pollution and a high level of energy dependence. It must be acknowledged that imported coal is not a solution to the issues of climate change nor air pollution.”

The pollution issues around the coal power stations do not just affect air quality. They also have a large impact on the Black Sea. The water around the power station is reported to be 4o warmer than elsewhere, as it is used in the power stations cooling processes and then returned warmed to the sea. Local people report seeing a sheen on the water from the heavy metals and other toxins which are released from the power stations. Burning coal high in sulphur increases sulphur dioxide which produces acid rain, and acidifies lakes and streams. Black Sea fishermen say that the power stations are damaging fish spawning grounds and reducing their catch. Food which is sold to Istanbul and Ankara.

Coal is a contested subject in Turkey. While people living close to existing coal facilities want the secure jobs, there are protests against new power stations and a proposed lignite power station was cancelled in 2013, following protests. Mining accidents are fairly common, with 301 killed in just one accident in Soma in 2014.

In the high up mountain village of Kokurdan (official name: Körpeoğlu) a coal ash and waste dump billows clouds of dust onto the dense trees surrounding the settling pool. Ash from the ZETES power stations and the dirt from the air filters are settled in a vast open dump. Although Coal Action Network visited immediately after heavy rain had washed the dust off the vegetation, homes and roads, the waste from ZETES coal power stations normally accumulates in the lungs, homes and crops of these people.

Villagers approached Coal Action Network to ask why we would want to visit their area when the coal facilities cause such contamination. “I hate being from here because of the pollution. When the weather is dry the dust covers everything.” one woman told Coal Action Network, whilst passing on the street in Kokurdan. In this village they are not convinced the damage is worth it because of the jobs. Local people say nothing good about the coal power plants, they just talked about the damaging health effects, adding liver cancer and stomach cancer to the list of illnesses caused by the coal power stations.

The most basic air pollution controls are not being implemented – lorries carrying coal are not even covered to prevent dust spreading along its route, a measure that long ago became standard in the UK. Public roads also run underneath the conveyor belts of ZETES power stations.

Monitors for fine dust particles known as PM10 are apparently not operational around the steelworks. PM2.5, is finer particulate matter that can penetrate the lungs and even enter the bloodstream and cause chronic diseases such as asthma, heart attack and bronchitis. PM2.5 is not monitored at all around Ereğli.

Coal Action Network’s visit to four coal facilities on the Black Sea showed that the human and environmental costs of burning coal are high. The issues of health, local environment and climate change are not being sufficiently addressed, but there is demand for improvement within Turkish communities living close to coal facilities.

In Spring 2024, Coal Action Network investigators visited Turkey to see first-hand the impacts that imported coal was having on communities living near steelworks and power stations using coal.

At that time, planning permission was in place for West Cumbria Mining Ltd to extract 2.78 million tonnes of coal a year, until 2049, from a coal mine under the sea near Whitehaven, Cumbria, UK.

The majority of the coal from Whitehaven would have been for export. However, the coal from Whitehaven has a high sulphur content, meaning European Union countries can’t use this coal in their blast furnaces due to air pollution standards and the UK blast furnaces will be replaced by Electric Arc Furnaces, to recycle scrap steel instead.

Therefore, of the countries listed by West Cumbria Mining Ltd as potential markets, only Turkey would have been a viable option.

Although the coal was considered to be coking coal, its actual end use would have depended on who bought it. Coking coal is a higher quality product, normally too expensive for power stations to use, but with its high sulphur content reducing price, Cumbrian coal could have been bought by Turkish power stations.

Shortly after our visit to Turkey, a General Election was announced in the UK. The victory by the Labour party, pushed out the Conservative Government which had approved the new coal mine in Whitehaven in December 2022.

Less than a month after the new Labour Government was formed, a court case was heard that had been brought by South Lakes Action on Climate Change and Friends of the Earth against the previous Conservative Government’s approval of the coal mine. The new Labour Government decided not to defend the previous Government’s decision to approve the coal mine. The Judge removed the planning permission for the coal mine in September 2024.

This momentous decision was reinforced by the Coal Authority subsequently declining the license application for the coal mine. There remains a final decision from the Labour Government regarding the application, but it is considered very unlikely to win the required permissions now.

We’re publishing this article on Turkey’s coal use because of the generous help that we received from Turkish people during our investigation, although it is no longer part of an active UK campaign.

The scientific consensus is that we need to decarbonise heavy industry. Steelworks are amongst the worst carbon emitters. Both of the UK steelworks using coal have agreed to convert to electric arc furnaces, a process which sadly requires far fewer steelworkers. When Port Talbot stopped its coal consuming blast furnaces at the end of September there was a poor deal for the workers. British Steel and the government must do better for the workers at Scunthorpe’s steelworks, expected to turn off the blast furnaces by the end of the year.

Former steelworker, Pat Carr, spoke to Anne Harris from Coal Action Network about the financial support offered to workers when the Consett steelworks closed in 1980, and they discussed what can be done better, in workplaces like Scunthorpe steelworks.

Read the full article, in the Canary Magazine from this link

The proposed West Cumbria Coal mine lost its planning permission in September 2024. Since then, its application to get a full coal mining license was refused by the Coal Authority, another nail in the coffin of the proposed coking coal mine.

The Coal Authority use a narrow (and outdated) check list to approve full coal mining licenses.

The Recommendation report from the Coal Authority for this application rejects the application for a full mining license for failing to satisfy both condition 2 and 3, of the above list.

The Coal Authority was unable to verify West Cumbria Mining Ltd's claims of low subsidence risk as West Cumbria Mining Ltd refused to give its modelling parameters to the Coal Authority, citing confidentiality.

Concurrently, the Coal Authority was not satisfied that West Cumbria Mining Ltd is able to finance the project and discharge liabilities especially now that the planning permission has been overturned.

Additionally, the deadline has passed for West Cumbria Mining Ltd to appeal the decision made by the Judge, Mr Justice Holgate, overturning the planning permission granted by the Conservative Government in December 2022. Friends of the Earth’s legal team has had confirmation that no appeal was received before the deadline, meaning an appeal won’t go ahead.

Next steps are still awaited from Angela Raynor, Secretary of State for Housing, Communities and Local Government, on how the government will proceed, but the chances of this mine ever happening are increasing very slim.

Pat Carr is a resident of Dipton, County Durham, he worked, alongside many members of his family at Consett Steelworks, before it was closed down. In 1980 the Nationalised British Steel Corporation sought to prioritise coastal steelworks that could more easily import iron ore and export finished products, which was the end of the inland steelworks.

Below is the transcription of an interview of Pat Carr, with his son Liam by Clara Paillard (Tipping Point) and Anne Harris (Coal Action Network).

Coal Action Network was interested to find out what was successful about the redundancy package for workers being let go as Consett steelworks closed and what lessons can be learnt for a truly Just Transition of current high carbon industries, such as Scunthorpe steelworks, making redundancies or closing due to the climate crisis. We are worried that the workers at Scunthorpe will suffer the same poor deal of workers at Port Talbot, as both blast furnace steelworks are converting to produce steel using electric arc furnaces rather than blast furnaces using coal.

(Transcription of the interview, edited lightly for clarity. To listen to the recording click here.)

Question: Can you give us an introduction?

“I worked in the steelworks for 11 years. In the steelworks, as a steelworks operative you start as a labourer and then you filled in for all the different jobs on a day by day basis, until you picked a line that you wanted to go into. So you could be on the furnaces or... or boiler cleaning, so there are lots of different lines of labouring type work. And I was on the furnace line… I was the senior labourer there. Therefore you got the first job choice for each day. The system was that you had a lieu day, each worker was on a 40 hour week, therefore it was a constant shift system... Each job had to be filled on that rota. Each day you checked who was in and who was on sick, checked all the cards, saw where the vacancies were, the different roles in the steelworks and then you filled them in down the line, so each of the labourers did that. So, that’s what I did for 11 years, but mostly on the furnaces, the O2 furnaces.”

“... Yeah, you change shifts every two days. So you might be on night shift Monday, Tuesday, and then you might go back to 2pm -10pm Wednesday, Thursday, then you’d be 6 o’clock in the morning until 2 in the afternoon Friday, Saturday, Sunday, Then you get your two days off. So you change shifts constantly."

Question: You must have been a young man when you started, how old were you?

"20 years old."

Question: Am I right to say that at the time it was still the British Steel Corporation? It was still a nationalised company?

"Yeah, the British Steel Corporation, yeah. That was the organisation yes."

Question: When you started at 20 did you think that was going to be a job you’d be in for a long time? Or was 11 years quite good innings?

“I just needed a job, so I just took it at that age. I’d previously been a student and it hadn’t worked out. Thought I might want to go into teaching but I decided I didn’t want to, so that didn’t work out. So, I ended up in the steel works at that age… I was made was made redundant once during that time, the steelworks has always been a strange industry of peaks and troughs. Lots of people who were started there were taken back on and so was I... There was one time, after a couple years where I was made redundant, but it was only for a 6 week period, then trade picked up again and you’re taken back on and end up in the same place.”

“In our street there was me and my brother. And my father had been a miner but then he ended up in the steelworks as the mines were closing down, but he started after me. My brother he worked elsewhere and then he ended up there, laying train tracks in the steelworks. My cousins down the street, they lived a few doors away from us. and their father worked in the steel works, their mother worked in the steel works. My closest cousin, who was about the same age as me, he started at the same time as me and we went through all the steelworks together for 11 years together. His brothers worked in the steelworks and his sister worked in the steelworks cos she was a nurse and she worked in the medical centre in the steelworks. So that was a whole family virtually, two adults and six siblings. Lots of families. Women worked all over the steelworks.”

Question: Were workers members of a trade union, and if so, which one?

"It was called BISAKTA when it started, British Iron, Steel and Kindred Trades Association. Then it became ISTC. [Iron steel trades confederation.] They just changed the name slightly. Iron Steel Trades Confederation.”

Liam “Did it turn to GMB in the end?”

“No, I’ve no idea what it is now. I don’t know how many steelworkers there are left, probably very few.”

Question: there are still some, a big union representing steelworkers is called Community it is probably one of the decedents of the unions you mentioned.

“It was the ISTC in 1980.”

Questioner: When steelworks were up for complete closure what happened? What was the year that it happened, why did it happen? How did people in the community or workers respond to that decision?

“There had been a miners strike the year before, we were then on strike earlier that year for the early part of that year. We were on strike for 10 weeks or something like that. In the winter of that year and there had been talk of closures all over the place and we were still trying to campaign to keep the Consett steelworks open. But I think it is a wearing down process… our family were all still resolute that they should be kept open. But there were others that were starting to waive and then they started to offer all kinds of incentives to take redundancy payments, enhanced payments, training schemes and all kinds of things, which may have swayed some of them. As far as I recall that took maybe eight months of negotiation, including marches in London and marches in the locale. Eventually the closure was complete in about September that year.”

Question: during that time when they were trying to close the steelworks, were people arguing that there should be a Just Transition and training, or were people just saying that it shouldn’t close at all?

“There were a lot of people campaigning that it shouldn’t close at all, that it was so crucial to the local economy. Although, there was maybe 3,500 people working in the steelworks itself there was probably another 3,500 people that were dependent on that with all the transport links and ancillary works that went on and all the contractors that were brought in to do other tasks. So there was probably almost twice as many were involved but didn’t have a say, because they weren’t directly involved in the steelworks.”

“Just prior to that, the year before they did close Hownsgill steel, they had a big plate mill. It’s a massive complex a steelworks, so you have the iron making and then that moves onto the steelmaking, and that rolls into ingots that can be made into other things. And then some of the steel was sent up to Hownsgill that was just another part of the steelworks, where it was rolled into plate...maybe 40 foot long plates, maybe an inch thick and 6 feet wide, or something like that. So all these plates were rolled there, and the year before there was an argument put that if Hownsgill wasn’t part of the same scheme, if they closed Hownsgill, then the rest of the steelworks could be viable… It was supposed to make us more viable, but as it proved it didn’t matter that much. All that meant was that all those people at Hownsgill didn’t get the same terms and conditions that we came out with, because we had a national negotiation closing the whole steelworks and they never got that. So they went on much inferior terms to the rest of the site than the rest of the steelworks got for want of a year’s grace.”

“The redundancy payments if I can recall were quite generous. Virtually everyone in the steelworks, even if you’d been there a year or two you got 6 months pay and I’m not sure you didn’t get another six months pay a year later. So I think that was part of it. It was quite good for that time and absolutely incredible for this time to get a year’s money. So that was a bit of a sweetener. So that was redundancy payments, or severance pay I think it was called at the time. Cos redundancy payment was a nation scheme and the severance pay was enacted through the union and the steel corporation… then you got your ordinary redundancy was calculated on top of that, you got maybe a week and a half for every year that you worked in the steelworks. So that was an extra payment on top, and if you had another job to go to that sounds OK, it was a pretty good sweetener. An extra year’s money, plus another job on a similar basis, but unfortunately, the vast majority of people didn’t have that other job to go to.”

“For the year afterwards it was a bit of a boom town because of course all this money was swilling around, everybody had more money that they’d ever had, in cold hard cash, but without the prospect of it going on. It meant people were getting new cars, I think a lot of the local garages did very well out of it for instance for a couple years. You could put a deposit down on your house, or start buying your council house that kinda thing. It was a bit of sweetener for some. But that’s fine if you’re 60, you’re old, and you get that, and your pension isn’t too far away. Then it seems to work OK, but if you’re 20, 25 or 30, then you’ve got the whole of your working life ahead of you... If you wanted that role to be out in the steelworks, then that was never going to be the option again.”

“We got severance money, we got our redundancy money and, if you went on a training scheme, any recognised training scheme, you got your normal wages that you got in the steelworks for the time you were in the training scheme, for up to one year. That was another year’s bonus where you could go into virtually any eduction scheme. So that was another boom area… they were putting courses on for everybody to do anything. No matter if you had any prospects in it or you were even interested in it, you were a fool not to go onto it cos it meant that you could get a year’s money which you weren’t having to sign on the dole.”

“The local further education was at Consett Technical College, they started running courses all over the place so that they used Working Men’s social clubs, in any old schools, any old buildings that they could put 10-15 steelworks and the tutor they got the money for that. And the steelworkers got the money for it as well, so they were paid their normal wage, so everybody was into education for one year.”

“I’m guessing the money came through the British Steel Corporation because I haven’t heard of it being done anywhere else, so I’m guessing it came through British Steel Corporation and through the government as well. I think there must have been a government incentive to try as at the time they were trying to shut down all sorts of things. It was the time when Thatcher was just about getting into her stride… It was the same feller who went on to the mining [Liam interrupts with “MacGregor”] MacGregor yeah, I think he was working on closing the steelworks at the same time as he was being groomed to sort out the national coal board at the same time.”

“I went down to, it is Sunderland University now. I was doing data processing, it’s an IT course, computer science, it was a degree course… But my father went, he wasn’t very, he wasn’t a great scholar in his youth and he was barely literate, but he went on a course because it was a free year."

"So you go on a reading and writing course, any course, but I actually did a degree in data processing and ended up in computers, computing...and that’s what I worked in most of the time since then, either computer programming or systems analysis, that kind of work.”

“My brother did much the same, but he went straight into, I’m not sure he did the training but he got a job at the national [….] but on the computer side. My cousin who lived down the street, he came with me on the same course, so we ended up doing the same course. We didn’t do the first year, but we ended up on the same course again… There was some who saw a career opportunity and others who wanted the money regardless. If you were 55, which I think that me father would have been by then probably, he needed the year’s money so he went straight into that, and he did a course just because cos it was a simple way to keep the wolf from the door.”

“There might have been a cut off time of a year” [working at the steelworks to get the money to retrain]

“Literacy courses were just as vital as any higher level courses, they were just as vital to those people… It was an absolute boom time. My father did his course in the working Men’s Club, there wasn’t enough facilities to cater for everyone who wanted to do the courses.”

Question - what was the role of the unions?

“I’m not certain who was doing that negotiation, but I think that that was the sweetener because I’m not sure there was a massive vote and they voted to close that plant in the end. Because it must have been close to it, a 50 : 50 split as to close the place or keep fighting on and possibly loose all of those enhanced conditions. Or whether just to hold up and take the enhanced conditions. I was never quite sure if there was a vote on that and that’s the way it went eventually. There wasn’t a prescribed vote on that. There was never a sheet of paper, I think there would just be a show of hands in a mass meeting.”

“It’s the best one I have heard of, I’m not sure what the pit closures got. It must have been around the same time as pit closures, or in the next four years, but I don’t think they got that same enhancement.”

Question: What could be learnt for current transitions?

“Certainly the education and training certainly helped me massively. I would never have thought of going into it, I always had at the back of my mind that I could have been doing something other than working at the steelworks, but I wouldn’t have jumped ship because the jobs was so good and the money was so good in the steelworks, so you would never leave it on that basis. Having been pushed into it, it wasn’t the most dreadful thing that happened to me. It worked out not too bad."

"There were hickups, it wasn’t all plain sailing so the first job didn’t work out that I got after qualifying... The eduction did work out for me long term, that’s what I needed at that time. We’d just had our 4th child so I needed a job at the end of the education... it had to have a concrete task at the end of it. And actually it… was quite good because the course that I went on, as well doing your 3 years, it was a sandwich course. So I also had one year out in industry, which meant I earned the money for that year. And therefore I got an extra year earning at the same time as the education was going on. So that worked out quite well as well.”

“I did a three year course with a year in industry where you were out and working for the year, so you got the wages as well so you weren’t reliant on… at the time I think I could claim unemployment whilst at college cos the hours were, the attendance hours weren’t massive. So you could still register as unemployed, I’m not sure it was legal or not, but it was the route I took. So I could claim unemployment benefit whilst still attending college.”

What was the situation 5 years on?

“It was definitely boom and bust, after that one of the local politicians said it used to be a BSc town, but now it’s a MSC town, meaning Manpowered Services commission, cos there was a time when if you registered unemployed they sent you on all kinds of retraining courses, which were unusually insignificant but I think that after that first 4- 5 years it definitely took a slump, the local economy. It’s virtually a dormitory town now, everyone travels to work.”

“There are industrial estates.. there were things brought in, probably on grants. Electrac which was supposedly a new form of electricity supply to your home where you could plug in anywhere in any room which sounds quite attractive now...There were some bits and pieces that came in, a little portion of the aerospace industry that came into an industrial estate in Consett, but never with the scale of the steelworks. Maybe a hundred workers would maybe be the size. Some food industries came.”

“They were probably dragged in with government incentives as it was now in a dire state economically and so there were extra incentives to bring those works into the area.”

Question - Was there new industry created locally?

“One or two of my friends went down to Teeside cos there was still a steelworks in Teeside. And they worked down there on the new steelworks down there. But not a lot, I’d guess way less than 1% actually went to Teeside.”

“There was nowhere, if the steel industry is suffering in one area it’s not going to be suffering everywhere. If it’s not going well in Consett it won’t be going well in Teeside either. All they were doing was filling in jobs, vacancies where if they knew that role they could move into that.”

“Actually I did know one lad who went to Mexico to build steelworks. I think British Steel Corporation were being employed to build new steelworks in different areas of the world in the far east and Mexico and they were building that while undercutting themselves. So there were some people who did that, went away. Then there were some people who were working on pulling the steelworks down cos that was a massive project, it was an absolutely gigantic project Project Genesis it’s still going on now, I’m not sure it’s ever going to finish. But the actual pulling down that took at least 5 years and then pulling up all the rail lines and that kind of things, you loose your railways as well. Because that was just there to serve steelworks… it was only goods at that time. The last passenger was prince Charles just after the closure. And they ran a passenger train. King Charles as he is now, I think it was the only passenger train that ran for several years…”

Anne says it makes it hard to go to work if you lose the rail station.

“Luckily, my cousin went the same place and I knew people around the area who were all going down to Sunderland so we used to share journeys down there.”

“It’s hard to extrapolate now as you’ve seen virtually every centre in Great Britain fall prey to all kinds of things… it probably had a boost for about 2 years and then it slowly drifted down and became less and less viable to shop in Consett and the centre its self. And at the same time there was lots of out of centre shopping being brought in... The middle of Consett isn’t too badly served with large shops, you’re still within walking distance of the centre of Consett to a lot of the super markets so but the main streets, the main streets everywhere are struggling. I think the pub trade took a hit, it took a massive boost and then of course, it took a massive hit after 4 or 5 years so instead of being 20 pubs in Consett there is probably 10 now.”

Question - Would you have stayed in the industry if you could?

“Absolutely not.. I enjoyed the work and I enjoyed working at the steelworks and I enjoyed working on the furnaces. There was always a slight niggle at the back of your head that you should be doing something else, but it was good work and good money, so I would never have moved. The first job I got after that I was having a cuppa and the boss came in and said “this is different from what you used to do”. It was my first job in Tyne and Wear and I said, “yeah it is different” and he said “this is far better isn’t it I bet you’re glad you’re doing this”, and I said, “actually I wish I was night shift going to the steelworks,” and that was about four years after I’d finished.”

Question - What messages do you have for current workers in high emissions industries?

“I would hope the allied industries would pick up on that, so you’d hope that the green side of that same industry would pick up some of the slack and maybe that’s where the retraining should be focussed and move onto that side rather than persevere with the one we’ve got.”

Clara says report published by climate orgs working with oil workers and 80% of oil and gas workers would be open to retraining. Anticipating collapse.

“Although there must have been pre-planning that we weren’t involved with, you never saw that… It was as good a deal as I’ve seen anywhere the scheme that we got. I don’t think it is has bettered since and I doubt it has been approached since.”

Clara says we will bring this back the message of what you benefited from at the time to those working on Just Transition in oil and gas industries.

Anne - we're working against 2 coal mines and for decarbonisation of the two major steelworks using coal. The company and the government aren't really giving the workers any kind of transition period. They are sort of blaming activists for steeling jobs, when the coal mine was supposed to close [Ffos-y-fran].

“It was always a bit of an incentive,... when Joanne was on planning at the Council and they were looking for opencast permissions and they used to send workers from Banks to the house and they to say, “what we could do is have more workers here and 10 workers or something.” and I used to think, “yeah, you can have 10 workers, but bleeding heck, it was an absolute drop in the ocean compared with what had been in pit”... It was just a sock for those workers and I think they were being used by the management onto decision makers and local authorities. It was hard to put an argument against them because they had such a vested interest in it. They saw it as you taking their job away. They were different times.”

===Ends===

Smoke filled the sky across the industrial parts of the UK, as coal powered the industrial revolution. First coal brought prosperity and progress, but over decades the smoke stacks have been identified as a major cause of the climate crisis.

Over the last 20 years the UK has changed dramatically, with the closure of Ratcliffe on Soar power station at the end of September 2024, marking the beginning of a coal free era. As recently as 2012, coal provided 40% of the UK’s electricity, with around 40 coal mines extracting 17.1 million tonnes of coal, with an additional 45 million tonnes of coal imported from Russia, Colombia and the USA.

Ratcliffe on Soar, near Nottingham opened in 1967, with a capacity of 2,000 megawatts, enough to power 2 million homes. Since the early 2000s people across the UK have campaigned against coal power stations, coal mines and other coal infrastructure. Coal is the greatest historical cause of climate change and still a major global contributor of green house gas emissions.

In 2015, the UK was the first country to announce it would phase-out coal by 2025. While lauded as a big climate victory the Government’s intention was also to ensure coal didn’t exit the UK’s grid any earlier than 2025. At the time coal still contributed 9% of the UK’s electricity supply.[1]

Ratcliffe power station has seen its fair share of protests demanding closure. One example of direct action took place on the site in 2007, when Spring into Action, saw 11 people locked on to the dumper trucks and the conveyor belts, feeding coal to the power station. This caused major disruption to the plant operation, before they were removed. Back then Ratcliffe was the UK’s 3rd largest source of carbon dioxide emissions in the UK.

One of the group occupying the site said “the threat of climate change is so huge and the government so complacent that the people themselves are now acting in proportionate response to this and targeting the root causes of climate change.”

In a far cry from recent sentencing, in 2009, when 114 people were pre-emptively arrested from a meeting place in Nottingham, they were found to have been intending to occupy Ratcliffe for as long as possible. When activists were sentenced, one judge declared they acted with "the highest possible motives".i They accepted that they were intending to close the power station, but said that the urgency of climate change meant they had to take this action.

Undercover police officer Mark Kennedy, was involved in organising actions against Ratcliffe power station and as such some of the convictions were later overturned.

Three years ago, prior to the Glasgow COP climate summit, the phase-out date was brought forward to 2024. The UK wanted to be seen as a climate leader in phasing-out coal and setting up the Powering Past Coal Alliance with Canada in 2015, but others got there first.

Although the UK was first to announce the end of its coal power sector, Belgium was the first European nation to stop burning coal, ending its use in 2016. Sweden stopped using coal in 2019, bringing forward the planned date by 2 years. Austria stopped using coal in 2020. Neither the Belgium nor Austrian phase-outs were considered to be government driven.i Portugal brought forward its phase-out date twice from a starting point of 2030 to 2021.

The UK Government extended the life of coal power stations after Russia invaded Ukraine. Drax, West Burton and part of Ratcliffe coal power stations were kept from retiring in 2022, in a fear that Russian warmongering would endanger electricity supply. The UK stopped Russian coal imports in response to the war.

In 2017, the UK had sourced 49% of its imported coal from Russia, where coal mining contributed to cultural genocide and laid waste to large areas of the country, decimating rivers, forests and agricultural areas.

Imported coal comes with a high toll for the local populations and campaigners in the UK have been pushing for an end to imports of coal from Russia as well as Colombia, while calling for the end of its mining and use in the UK. Over the years London Mining Network has brought visitors to the UK from international coal affected regions, particularly in Latin America. Meeting these campaigners has been profoundly moving experiences for people living close to proposed coal mines in the UK, as the similarities in their struggles are numerous, and it shows that the campaigns are thinking globally by acting locally and pushing for the end of coal power.

The movement against coal power in the UK has been wide, with people standing up and saying no to opencast coal mines near their homes and joining together to stop 45 planned new opencast coal mines from operating. Significant battles were fought at Lodge House in Derbyshire, in the Pont Valley in Durham and Ffos-y-fran the UK’s largest opencast mine, which was allowed by the Welsh Government to mine coal for an unbelievable 15 months after planning permission ended.

Coal Action Network has worked with communities resisting opencast and later deep coal mining across the UK. From its inception in 2008, it has supported more than 25 communities to stop coal mines and extension from destroying local wildlife, filling local people’s lungs with dust and the industrialisation of the countryside.

Site occupations have been a significant tactic in slowing or stopping coal mines from starting. Coal Action Scotland occupied several sites including Mainshill and later Glentaggart East, both in South Lanarkshire for action camps that disrupted operations on existing opencast sites. Scotland’s last coal power station, Longannet closed in March 2016, and the Scottish Government banned coal mining in 2022, in a protest against the proposed West Cumbria coal mine.

In 2018 the last two opencast coal mines started, both in County Durham, opposition to the one in the Pont Valley a protest camp was set up and featured in the urgent film documentary Finite: the climate of change. This campaign, and others in the North East had brought the local opposition to coal extraction to a head and in 2020 the proposed mines at Druridge Bay, and Dewley Hill were rejected, along with an extension to the Pont Valley opencast. Support for coal had turned a corner.

With the coal-phase out announcement and pressure on opencast coal mines coal companies started saying that their coal was destined for use in the steel industry. The second and third biggest single site emitters of carbon in the UK were Port Talbot steelworks and the steelworks at Scunthorpe. Drax power station has the dubious honour of being the biggest carbon emitter, which although it no longer burning coal, it does burning trees from old growth forests.

In September 2024 the planning permission for the proposed West Cumbria coal mine was revoked and then the license from the Coal Authority was rejected. Communities in Cumbria and beyond fought long and hard to bring about these results which were cemented in court by South Lakes Action on Climate Change and Friends of the Earth.

[1] Digest of UK energy Statistics 2017, page 14

Campaigners celebrate as the decision to allow a new coal mine in Cumbria is quashed.

Today, 13th September, South Lakes Action on Climate Change and Friends of the Earth won their case, against the Conservative Government's 2022 decision, to allow a new coal mine. Following a hearing in the High Court in July 2024.

Delighted campaigners gathered outside the former County Hall in Kendal and in Whitehaven Market Place to hear the news together this morning.

The Judge, Mr Justice Holgate ruled, "The assumption that the proposed mine would not produce a net increase in GHG emissions, or would be a net zero mine, is legally flawed"

The case was won on 4 out of 5 grounds and the Judge rubbished the mining company's claims the mine would have been net zero.

Maggie Mason, South Lakes Action on Climate Change said, "As ordinary responsible people, we saw this horrendous example of fossil fuel company arrogance, the weakness of our local government, we knew enough science to know the terrible impacts this would have on our beautiful planet and people, the poorest and most vulnerable first."

"We could not stand by and do nothing to prevent it. We needed to tell the truth, work hard and pitch in some money to get a legal team that understood the issues."

The following were ruled against the mining company.

Issue (i) – breach of the 2011 Regulations, (ii) – the substitution issue (iii) - Impact of granting planning permission on UK’s leadership role in promoting international action on climate change (iv) Arrangements for offsetting GHG emissions from the operation of the mine

Issue (v) – Unlawful disparity in the treatment of the parties’ cases - was not agreed.

This victory means that 60 million tonnes of coal and associated methane will likely be left underground. West Cumbria Mining Ltd, could appeal the decision. Angela Rayner, the Secretary of State for Housing, Communities and Local Government, needs to decide how to proceed now the decision has been returned to the Government.

From Tuesday 16th July to lunchtime 18th July, Lord Holgate heard the case, brought by South Lakes Action on Climate Change and Friends of the Earth, against the Government’s 2022 approval of a new underground coal mine at Whitehaven.

In the preceding week the new Government accepted the decision of the former Government was legally flawed, and has conceded the legal challenges to the approval. A Barrister representing the new Secretary of State, Angela Rayner, was present on the request of the Judge, but made no submissions.

Demonstrations in support of the court case were held in Whitehaven on the evening before the case began and on the first day of the hearing. In London, there was a demonstration before the start of the case, outside the High Court and a meeting of Quakers at lunch on the second day.

Estelle Dehon KC of Cornerstone Barristers representing South Lakes Action on Climate Change and Friends of the Earth’s Barristers as to why the mine should not have been granted permission. This was based on the lack of consideration of emissions on use of the coal (the Finch case precident); errors in the Environmental Statement; the false argument that coal mined in the UK, means less mining abroad; failure to comply with the 6th carbon budget; and inconsistency of treatment of parties in the planning inquiry.

The Judge, Lord Holgate had ruled against Sarah Finch at the High Court, before she won her case in the Supreme Court. The Finch case law was much debated during the hearing looking at the Whitehaven coal mine. It states that emissions from the consumption of fossil fuels should be considered when deciding planning applications for new fossil fuel production.

Barrister James Stratchan KC for West Cumbria Mining Ltd set forth its case that the coal from Cumbria would perfectly substitute for more expensive coal from the USA so overall there is no increase in emissions. This assumes that coal mines with permission to be extracted coal in the USA would chose to leave the coal underground in an equal measure to it is extracted from this site. He tried to argue that as this coal was coking coal normally used in coal power stations, and as such it shouldn't be considered as a fossil fuel and therefore sought to avoid discussing the recent Finch victory.

Lord Holgate engaged in detail with the points put before him, but is not expected to deliver a decision until after some weeks of deliberation. If the case is upheld the decision would then be returned to the Secretary of State for a fresh decision, a process which is also likely to take weeks or months and involve another public inquiry, which may be limited in scope.

We will let you know when we have a decision to report on.