Pat Carr is a resident of Dipton, County Durham, he worked, alongside many members of his family at Consett Steelworks, before it was closed down. In 1980 the Nationalised British Steel Corporation sought to prioritise coastal steelworks that could more easily import iron ore and export finished products, which was the end of the inland steelworks.

Below is the transcription of an interview of Pat Carr, with his son Liam by Clara Paillard (Tipping Point) and Anne Harris (Coal Action Network).

Coal Action Network was interested to find out what was successful about the redundancy package for workers being let go as Consett steelworks closed and what lessons can be learnt for a truly Just Transition of current high carbon industries, such as Scunthorpe steelworks, making redundancies or closing due to the climate crisis. We are worried that the workers at Scunthorpe will suffer the same poor deal of workers at Port Talbot, as both blast furnace steelworks are converting to produce steel using electric arc furnaces rather than blast furnaces using coal.

(Transcription of the interview, edited lightly for clarity. To listen to the recording click here.)

Question: Can you give us an introduction?

“I worked in the steelworks for 11 years. In the steelworks, as a steelworks operative you start as a labourer and then you filled in for all the different jobs on a day by day basis, until you picked a line that you wanted to go into. So you could be on the furnaces or... or boiler cleaning, so there are lots of different lines of labouring type work. And I was on the furnace line… I was the senior labourer there. Therefore you got the first job choice for each day. The system was that you had a lieu day, each worker was on a 40 hour week, therefore it was a constant shift system... Each job had to be filled on that rota. Each day you checked who was in and who was on sick, checked all the cards, saw where the vacancies were, the different roles in the steelworks and then you filled them in down the line, so each of the labourers did that. So, that’s what I did for 11 years, but mostly on the furnaces, the O2 furnaces.”

“... Yeah, you change shifts every two days. So you might be on night shift Monday, Tuesday, and then you might go back to 2pm -10pm Wednesday, Thursday, then you’d be 6 o’clock in the morning until 2 in the afternoon Friday, Saturday, Sunday, Then you get your two days off. So you change shifts constantly."

Question: You must have been a young man when you started, how old were you?

"20 years old."

Question: Am I right to say that at the time it was still the British Steel Corporation? It was still a nationalised company?

"Yeah, the British Steel Corporation, yeah. That was the organisation yes."

Question: When you started at 20 did you think that was going to be a job you’d be in for a long time? Or was 11 years quite good innings?

“I just needed a job, so I just took it at that age. I’d previously been a student and it hadn’t worked out. Thought I might want to go into teaching but I decided I didn’t want to, so that didn’t work out. So, I ended up in the steel works at that age… I was made was made redundant once during that time, the steelworks has always been a strange industry of peaks and troughs. Lots of people who were started there were taken back on and so was I... There was one time, after a couple years where I was made redundant, but it was only for a 6 week period, then trade picked up again and you’re taken back on and end up in the same place.”

“In our street there was me and my brother. And my father had been a miner but then he ended up in the steelworks as the mines were closing down, but he started after me. My brother he worked elsewhere and then he ended up there, laying train tracks in the steelworks. My cousins down the street, they lived a few doors away from us. and their father worked in the steel works, their mother worked in the steel works. My closest cousin, who was about the same age as me, he started at the same time as me and we went through all the steelworks together for 11 years together. His brothers worked in the steelworks and his sister worked in the steelworks cos she was a nurse and she worked in the medical centre in the steelworks. So that was a whole family virtually, two adults and six siblings. Lots of families. Women worked all over the steelworks.”

Question: Were workers members of a trade union, and if so, which one?

"It was called BISAKTA when it started, British Iron, Steel and Kindred Trades Association. Then it became ISTC. [Iron steel trades confederation.] They just changed the name slightly. Iron Steel Trades Confederation.”

Liam “Did it turn to GMB in the end?”

“No, I’ve no idea what it is now. I don’t know how many steelworkers there are left, probably very few.”

Question: there are still some, a big union representing steelworkers is called Community it is probably one of the decedents of the unions you mentioned.

“It was the ISTC in 1980.”

Questioner: When steelworks were up for complete closure what happened? What was the year that it happened, why did it happen? How did people in the community or workers respond to that decision?

“There had been a miners strike the year before, we were then on strike earlier that year for the early part of that year. We were on strike for 10 weeks or something like that. In the winter of that year and there had been talk of closures all over the place and we were still trying to campaign to keep the Consett steelworks open. But I think it is a wearing down process… our family were all still resolute that they should be kept open. But there were others that were starting to waive and then they started to offer all kinds of incentives to take redundancy payments, enhanced payments, training schemes and all kinds of things, which may have swayed some of them. As far as I recall that took maybe eight months of negotiation, including marches in London and marches in the locale. Eventually the closure was complete in about September that year.”

Question: during that time when they were trying to close the steelworks, were people arguing that there should be a Just Transition and training, or were people just saying that it shouldn’t close at all?

“There were a lot of people campaigning that it shouldn’t close at all, that it was so crucial to the local economy. Although, there was maybe 3,500 people working in the steelworks itself there was probably another 3,500 people that were dependent on that with all the transport links and ancillary works that went on and all the contractors that were brought in to do other tasks. So there was probably almost twice as many were involved but didn’t have a say, because they weren’t directly involved in the steelworks.”

“Just prior to that, the year before they did close Hownsgill steel, they had a big plate mill. It’s a massive complex a steelworks, so you have the iron making and then that moves onto the steelmaking, and that rolls into ingots that can be made into other things. And then some of the steel was sent up to Hownsgill that was just another part of the steelworks, where it was rolled into plate...maybe 40 foot long plates, maybe an inch thick and 6 feet wide, or something like that. So all these plates were rolled there, and the year before there was an argument put that if Hownsgill wasn’t part of the same scheme, if they closed Hownsgill, then the rest of the steelworks could be viable… It was supposed to make us more viable, but as it proved it didn’t matter that much. All that meant was that all those people at Hownsgill didn’t get the same terms and conditions that we came out with, because we had a national negotiation closing the whole steelworks and they never got that. So they went on much inferior terms to the rest of the site than the rest of the steelworks got for want of a year’s grace.”

“The redundancy payments if I can recall were quite generous. Virtually everyone in the steelworks, even if you’d been there a year or two you got 6 months pay and I’m not sure you didn’t get another six months pay a year later. So I think that was part of it. It was quite good for that time and absolutely incredible for this time to get a year’s money. So that was a bit of a sweetener. So that was redundancy payments, or severance pay I think it was called at the time. Cos redundancy payment was a nation scheme and the severance pay was enacted through the union and the steel corporation… then you got your ordinary redundancy was calculated on top of that, you got maybe a week and a half for every year that you worked in the steelworks. So that was an extra payment on top, and if you had another job to go to that sounds OK, it was a pretty good sweetener. An extra year’s money, plus another job on a similar basis, but unfortunately, the vast majority of people didn’t have that other job to go to.”

“For the year afterwards it was a bit of a boom town because of course all this money was swilling around, everybody had more money that they’d ever had, in cold hard cash, but without the prospect of it going on. It meant people were getting new cars, I think a lot of the local garages did very well out of it for instance for a couple years. You could put a deposit down on your house, or start buying your council house that kinda thing. It was a bit of sweetener for some. But that’s fine if you’re 60, you’re old, and you get that, and your pension isn’t too far away. Then it seems to work OK, but if you’re 20, 25 or 30, then you’ve got the whole of your working life ahead of you... If you wanted that role to be out in the steelworks, then that was never going to be the option again.”

“We got severance money, we got our redundancy money and, if you went on a training scheme, any recognised training scheme, you got your normal wages that you got in the steelworks for the time you were in the training scheme, for up to one year. That was another year’s bonus where you could go into virtually any eduction scheme. So that was another boom area… they were putting courses on for everybody to do anything. No matter if you had any prospects in it or you were even interested in it, you were a fool not to go onto it cos it meant that you could get a year’s money which you weren’t having to sign on the dole.”

“The local further education was at Consett Technical College, they started running courses all over the place so that they used Working Men’s social clubs, in any old schools, any old buildings that they could put 10-15 steelworks and the tutor they got the money for that. And the steelworkers got the money for it as well, so they were paid their normal wage, so everybody was into education for one year.”

“I’m guessing the money came through the British Steel Corporation because I haven’t heard of it being done anywhere else, so I’m guessing it came through British Steel Corporation and through the government as well. I think there must have been a government incentive to try as at the time they were trying to shut down all sorts of things. It was the time when Thatcher was just about getting into her stride… It was the same feller who went on to the mining [Liam interrupts with “MacGregor”] MacGregor yeah, I think he was working on closing the steelworks at the same time as he was being groomed to sort out the national coal board at the same time.”

“I went down to, it is Sunderland University now. I was doing data processing, it’s an IT course, computer science, it was a degree course… But my father went, he wasn’t very, he wasn’t a great scholar in his youth and he was barely literate, but he went on a course because it was a free year."

"So you go on a reading and writing course, any course, but I actually did a degree in data processing and ended up in computers, computing...and that’s what I worked in most of the time since then, either computer programming or systems analysis, that kind of work.”

“My brother did much the same, but he went straight into, I’m not sure he did the training but he got a job at the national [….] but on the computer side. My cousin who lived down the street, he came with me on the same course, so we ended up doing the same course. We didn’t do the first year, but we ended up on the same course again… There was some who saw a career opportunity and others who wanted the money regardless. If you were 55, which I think that me father would have been by then probably, he needed the year’s money so he went straight into that, and he did a course just because cos it was a simple way to keep the wolf from the door.”

“There might have been a cut off time of a year” [working at the steelworks to get the money to retrain]

“Literacy courses were just as vital as any higher level courses, they were just as vital to those people… It was an absolute boom time. My father did his course in the working Men’s Club, there wasn’t enough facilities to cater for everyone who wanted to do the courses.”

Question - what was the role of the unions?

“I’m not certain who was doing that negotiation, but I think that that was the sweetener because I’m not sure there was a massive vote and they voted to close that plant in the end. Because it must have been close to it, a 50 : 50 split as to close the place or keep fighting on and possibly loose all of those enhanced conditions. Or whether just to hold up and take the enhanced conditions. I was never quite sure if there was a vote on that and that’s the way it went eventually. There wasn’t a prescribed vote on that. There was never a sheet of paper, I think there would just be a show of hands in a mass meeting.”

“It’s the best one I have heard of, I’m not sure what the pit closures got. It must have been around the same time as pit closures, or in the next four years, but I don’t think they got that same enhancement.”

Question: What could be learnt for current transitions?

“Certainly the education and training certainly helped me massively. I would never have thought of going into it, I always had at the back of my mind that I could have been doing something other than working at the steelworks, but I wouldn’t have jumped ship because the jobs was so good and the money was so good in the steelworks, so you would never leave it on that basis. Having been pushed into it, it wasn’t the most dreadful thing that happened to me. It worked out not too bad."

"There were hickups, it wasn’t all plain sailing so the first job didn’t work out that I got after qualifying... The eduction did work out for me long term, that’s what I needed at that time. We’d just had our 4th child so I needed a job at the end of the education... it had to have a concrete task at the end of it. And actually it… was quite good because the course that I went on, as well doing your 3 years, it was a sandwich course. So I also had one year out in industry, which meant I earned the money for that year. And therefore I got an extra year earning at the same time as the education was going on. So that worked out quite well as well.”

“I did a three year course with a year in industry where you were out and working for the year, so you got the wages as well so you weren’t reliant on… at the time I think I could claim unemployment whilst at college cos the hours were, the attendance hours weren’t massive. So you could still register as unemployed, I’m not sure it was legal or not, but it was the route I took. So I could claim unemployment benefit whilst still attending college.”

What was the situation 5 years on?

“It was definitely boom and bust, after that one of the local politicians said it used to be a BSc town, but now it’s a MSC town, meaning Manpowered Services commission, cos there was a time when if you registered unemployed they sent you on all kinds of retraining courses, which were unusually insignificant but I think that after that first 4- 5 years it definitely took a slump, the local economy. It’s virtually a dormitory town now, everyone travels to work.”

“There are industrial estates.. there were things brought in, probably on grants. Electrac which was supposedly a new form of electricity supply to your home where you could plug in anywhere in any room which sounds quite attractive now...There were some bits and pieces that came in, a little portion of the aerospace industry that came into an industrial estate in Consett, but never with the scale of the steelworks. Maybe a hundred workers would maybe be the size. Some food industries came.”

“They were probably dragged in with government incentives as it was now in a dire state economically and so there were extra incentives to bring those works into the area.”

Question - Was there new industry created locally?

“One or two of my friends went down to Teeside cos there was still a steelworks in Teeside. And they worked down there on the new steelworks down there. But not a lot, I’d guess way less than 1% actually went to Teeside.”

“There was nowhere, if the steel industry is suffering in one area it’s not going to be suffering everywhere. If it’s not going well in Consett it won’t be going well in Teeside either. All they were doing was filling in jobs, vacancies where if they knew that role they could move into that.”

“Actually I did know one lad who went to Mexico to build steelworks. I think British Steel Corporation were being employed to build new steelworks in different areas of the world in the far east and Mexico and they were building that while undercutting themselves. So there were some people who did that, went away. Then there were some people who were working on pulling the steelworks down cos that was a massive project, it was an absolutely gigantic project Project Genesis it’s still going on now, I’m not sure it’s ever going to finish. But the actual pulling down that took at least 5 years and then pulling up all the rail lines and that kind of things, you loose your railways as well. Because that was just there to serve steelworks… it was only goods at that time. The last passenger was prince Charles just after the closure. And they ran a passenger train. King Charles as he is now, I think it was the only passenger train that ran for several years…”

Anne says it makes it hard to go to work if you lose the rail station.

“Luckily, my cousin went the same place and I knew people around the area who were all going down to Sunderland so we used to share journeys down there.”

“It’s hard to extrapolate now as you’ve seen virtually every centre in Great Britain fall prey to all kinds of things… it probably had a boost for about 2 years and then it slowly drifted down and became less and less viable to shop in Consett and the centre its self. And at the same time there was lots of out of centre shopping being brought in... The middle of Consett isn’t too badly served with large shops, you’re still within walking distance of the centre of Consett to a lot of the super markets so but the main streets, the main streets everywhere are struggling. I think the pub trade took a hit, it took a massive boost and then of course, it took a massive hit after 4 or 5 years so instead of being 20 pubs in Consett there is probably 10 now.”

Question - Would you have stayed in the industry if you could?

“Absolutely not.. I enjoyed the work and I enjoyed working at the steelworks and I enjoyed working on the furnaces. There was always a slight niggle at the back of your head that you should be doing something else, but it was good work and good money, so I would never have moved. The first job I got after that I was having a cuppa and the boss came in and said “this is different from what you used to do”. It was my first job in Tyne and Wear and I said, “yeah it is different” and he said “this is far better isn’t it I bet you’re glad you’re doing this”, and I said, “actually I wish I was night shift going to the steelworks,” and that was about four years after I’d finished.”

Question - What messages do you have for current workers in high emissions industries?

“I would hope the allied industries would pick up on that, so you’d hope that the green side of that same industry would pick up some of the slack and maybe that’s where the retraining should be focussed and move onto that side rather than persevere with the one we’ve got.”

Clara says report published by climate orgs working with oil workers and 80% of oil and gas workers would be open to retraining. Anticipating collapse.

“Although there must have been pre-planning that we weren’t involved with, you never saw that… It was as good a deal as I’ve seen anywhere the scheme that we got. I don’t think it is has bettered since and I doubt it has been approached since.”

Clara says we will bring this back the message of what you benefited from at the time to those working on Just Transition in oil and gas industries.

Anne - we're working against 2 coal mines and for decarbonisation of the two major steelworks using coal. The company and the government aren't really giving the workers any kind of transition period. They are sort of blaming activists for steeling jobs, when the coal mine was supposed to close [Ffos-y-fran].

“It was always a bit of an incentive,... when Joanne was on planning at the Council and they were looking for opencast permissions and they used to send workers from Banks to the house and they to say, “what we could do is have more workers here and 10 workers or something.” and I used to think, “yeah, you can have 10 workers, but bleeding heck, it was an absolute drop in the ocean compared with what had been in pit”... It was just a sock for those workers and I think they were being used by the management onto decision makers and local authorities. It was hard to put an argument against them because they had such a vested interest in it. They saw it as you taking their job away. They were different times.”

===Ends===

In May 2023, Coal Action Network wrote to the Climate Change, Energy, and Infrastructure Committee (CCEIC) of the Welsh Senedd, informing the Committee of the ongoing illegal coal mining at Ffos-y-fran in Merthyr Tydfil, and the Council and Welsh Government’s refusal to use their enforcement powers to prevent the daily extraction of over 1,000 tonnes of coal. After being informed of this context, the CCEIC committed to a short committee inquiry on Ffos-y-fran and the broader failure of restoration of former opencast coal mine sites, with oral evidence sessions in April and May 2024, in which Coal Action Network participated. In August 2024, the CCEIC published its report on the handling of Ffos-y-fran and restoration of opencast coal mining sites across South Wales, citing ‘missed opportunities’ and referring to Ffos-y-fran as “symbol of the system's failures”. Both the Welsh Government and Merthyr Tydfil County Borough Council (MTCBC) responded in September 2024 to the 26 recommendations contained in the CCEIC’s report. A selection of their responses are summarised or quoted below with our analysis following each. This is the brief version, check out our full analysis report with accompanying pictures.

The Welsh Government should commission an independent review to assess the extent of, the funding needed to restore opencast sites to an acceptable level. The independent, review should consider what constitutes an “acceptable level” in consultation with local, authorities and communities.

Welsh Government isn’t liable for funding a programme dealing with open cast mining and land reclamation. Welsh Government has had statutory powers over ‘derelict land’ since April 2006, to protect public safety, create development land and enhance the environmental and social well-being of Wales. In recent years funding for such activity “has been restricted”. The Welsh Government is therefore concerned that assessing the costs to restore open cast sites may create an expectation that Welsh Government will then fund that restoration.

The operator and landowner is responsible for restoration and aftercare of opencast sites. They must also ensure that sufficient finance is set aside to enable them to meet restoration and aftercare obligations.

The Welsh Government repeat this through its response to the CCEIC’s recommendations, yet not once explain who is responsible when the operator and landowner fail to, or claim not to have, set aside sufficient finance to restore the site – which has happened at around 7 sites within the past 10 years in South Wales alone.

The Welsh Government should require local authorities to ensure all Planning Officers’ reports are available online alongside associated planning documents, including revised, restoration plans, where relevant.

We agree that transparency in planning decision making must be achieved, however, insisting on specific web publishing requirements at this time is premature.

The thrust of recommendation 9 is to ensure Planning Officer’s reports are made public, as Planning Officers’ reports summarise in plain English numerous technical planning documents. Public access to this key report would greatly improve transparency. The Welsh Government should urge Councils to make Planning Officers’ reports publicly accessible, where possible.

The Welsh Government should reconsider the proposal from the 2014 report to establish a virtual “Centre of Excellence” for restoration planning, particularly in light of potential coal-tip reclamation proposals, and lead discussions with local government on how to implement this.

Given our existing presumption against coal extraction, we expect “very few schemes being brought forward”. Our primary focus is to ensure that disused tips are safe and to deliver a modernised, fit-for-purpose regulatory regime. After the disused mine and quarry tips Bill is passed The Welsh Government will take “a more detailed strategic approach to mining and industrial legacy in Wales – this will need to include reclamation of disused tips and management of open cast mining.”

Contrary to the Welsh Government’s expectation of “very few schemes”, right now there are two schemes proposing coal extraction in South Wales, and a further application to downgrade the remediation scheme for Ffos-y-fran is expected before the end of this year. All these schemes would benefit from the kind of oversight the CCEIC are proposing with its recommendation for a Centre of Excellence, so action by the Welsh Government is needed now rather than years into the future.

The Welsh Government must engage with the UK Government with the aim of removing the Coal Authority’s statutory duty to maintain and develop an economically viable coal mining industry.

Whereas we would wish for the Coal Authority to remove its statutory duty to maintain and develop an economically viable coal mining industry, this duty has no practical effect in Wales… The Welsh Government is confident that it has in place the necessary policy and processes to ensure the climate emergency and nature emergency are fully reflected in any decision making.

Contrary to the Welsh Government’s confidence, its policies were deemed compatible with an opencast coal mine extension just last year in 2023. Additionally, the Welsh Government Minister for Climate Change Julie James wrote to the UK Government in 2021 stating that: “…we consider the statutory duty of the Coal Authority to develop and maintain a viable coal extraction industry must be removed if we are to achieve our policy ambitions…”, which is at odds with the Welsh Government’s response to the CCEIC’s recommendation, and there hasn’t been relevant Welsh policy evolution in the meantime to explain this new position.

The Welsh Government should review and update the Minerals Technical Advice Note 2 (MTAN2) to ensure it is fit for purpose, particularly in the context of new developments and coal tip remediation.

Minerals Technical Advice Note 2 Coal (MTAN2) contains comprehensive planning guidance which is robust about restoration and aftercare schemes for coal extraction. Along with all other planning policy, MTAN2 is kept under continual review to ensure it is kept up to date, fit for purpose and relevant.

The Welsh Government released MTAN2 in 2009, so it fails to reflect the many relevant policy developments over the past 15 years. The Welsh Government’s refusal to review MTAN2 is also bewildering given the policy has ostensibly failed to secure decent restoration of numerous coal mining sites across South Wales since its implementation. MTAN2 needs to be reviewed in line with the CCEIC’s recommendation.

The Welsh Government should incorporate provisions for the restoration of former opencast sites within the forthcoming Disused Tips (Mines and Quarries) Bill.

“In his Legislative Statement on 9 July 2024, the then First Minister made clear that inclusion of provisions relating to restoration of former opencast sites within the forthcoming Disused Tips (Mines and Quarries) Bill (the Bill) is not feasible at this time.” The Welsh Government cites further delay due to expansion of scope, and affordability as the key reasons for its position.

Coal tips are created by the act of deep coal mining. Overburden mounds are created by the act of opencast coal mining – there is little difference between the two in their risk or cause. The other hazards posed by abandoned and under-restored opencast coal mining sites should also be dealt with in the same legislation, given their shared cause, similar urgency, and methods of resolution (monitoring, landscaping, and earth works).

The Welsh Government must mandate public consultation for all stages of the restoration process, including when revised restoration plans are brought forward.

Public participation is very important at all stages of the planning process and is to be encouraged. The wide range of development types and scales mean planning legislation can only set a minimum standard of consultation…however we expect planning authorities to consult where the public is materially affected by the submitted details.

A restoration plan represents a promise made to nearby communities before they endure what is often years of disruption, noise, and dust during subsequent coal mining. Accordingly, those communities should be meaningfully consulted on proposed changes to that promise, with their feedback given significant weight in shaping associated planning decisions and conditions. We ask if the Welsh Government will issue guidance to Local Planning Authorities to this effect, to act on its acceptance in principle of the CCEIC’s recommendation.

The Welsh Government should advise local authorities to designate a specific officer as a point of contact for the local community, providing a direct communication channel between residents and local authorities on matters relating to sites or similar developments.

MTAN2 recommends the mining company appoints a site liaison officer. Additionally, Local Planning Authorities have a Planning Case Officer before an application is approved, and the enforcement team for after an application is approved.

Within Local Planning Authorities, Case Officers often say they are too busy with their main work to engage more with public enquiries and concerns. Given the potential impact of planning applications on nearby communities, there’s clearly a need to have a dedicated contact point for community input and involvement. We ask if the Welsh Government will issue guidance to Local Planning Authorities to this effect, to act on its acceptance in principle of the CCEIC’s recommendation.

The Welsh Government should advise local authorities to create online portals where residents can access up-to-date information on all stages of the restoration process.

Insisting on specific web publishing requirements at this time is premature. The Welsh Government is working with the Centre for Digital Public Services (CDPS) in exploring how digital solutions can improve the planning system in Wales. It is anticipated that the communication of decisions will form an integral part of that work. This will bring together the variability currently seen across authorities in a managed cost-effective way.

The Welsh Government should expedite online public access to planning documents, and have facilitating public engagement as an explicit aim of this work. The poor design of some planning portals currently create barriers to community members accessing critical information about developments that will potentially impact them. We ask the Welsh Government to centre a public consultation in its design of digitalised planning systems.

The Welsh Government should encourage the use of citizens' assemblies as forums for discussing the future of restoration sites, particularly where restoration failed to meet the original planning permission and compromises need to be made.

National planning guidance already recognises that well established liaison committees help to provide a better understanding of the impacts to be expected from mineral extraction. Many quarries and coal sites have established liaison committees which act as a forum for regular discussion and explanation of current problems. Where regular complaints are received or there is concern about local impacts the local planning authority should request that the operator cooperate in establishing regular meetings of a nominated group.

We agree with the National Planning guidance’s promotion of community liaison committees, but find execution is inconsistent, and in some cases, absent altogether – even where there are serious breaches of planning control and trust. This has left some participating residents we’ve spoken with feeling ignored and apathetic. We ask if the Welsh Government will reconsider the sentiment of the CCEIC’s recommendation, by strengthening the National Planning guidance on community liaison committees.

The Welsh Government must explore stronger enforcement mechanisms to address breaches of planning controls without delay, such as the mining activities that continued at Ffos-y-Fran after the licence expired.

The Town and Country Planning Act 1990 provides a range of effective enforcement options depending on the circumstances. Enforcement is focused on addressing the unacceptable impacts of unauthorised development rather than punishing the developer. Given the complex nature of planning impacts on both the environment and people it is sometimes acceptable to allow unauthorised activities to continue while consideration is given to the best course of action. That is what Merthyr Tydfil County Borough Council concluded at Ffos-y-Fran. However, where unacceptable harm is happening, the law does currently provide authorities with powers to stop activities immediately, either through a stop notice or Court injunction.

Ffos-y-fran highlights that enforcement options are only robust to the extent that they can be implemented. For 15 months, Merthyr Tydfil County Borough Council believed the consequences of using enforcement options available to it were worse than allowing severe, long-term, harmful, and persistent breaches of planning control. This suggests that current enforcement options are not fit for purpose. Therefore we ask if the Welsh Government will reconsider the CCEIC’s recommendation and review existing planning enforcement options for their practical effectiveness in controlling largescale developments?

The Welsh Government should consider the broader implications of the failures at Ffos-y-Fran and implement systemic changes to prevent similar issues in future, including in relation to coal-tip reclamation sites.

Welsh Government coal extraction planning policy is clear that development proposals will only be approved in wholly exceptional circumstances. There will therefore be very few schemes being brought forward. At the present time, our primary focus is to ensure that disused tips are safe and to deliver a modernised, fit-for-purpose regulatory regime.

In the face of the Welsh Government’s expectation of ‘very few schemes’, there are currently two schemes in pre-application consultation (Bedwas Tips and an extension to Glan Lash) proposing coal extraction in South Wales, with remediation dimensions. Ffos-y-fran is a current example of the abject failure of planning control to secure the agreed restoration, even after allowing 15 months of illegal coal mining with an associated 1.6 million tonnes of CO2. Ffos-y-fran is not a lone example, but rather part of a history of planning control failing to deliver the agreed standard of restoration at East Pit, Selar, Margam Parc Slip, and Nant Helen within the past decade alone in South Wales. If the Welsh Government refuses to learn lessons from this egregious breach of its own national policy on coal mining, it calls into question whether the Welsh Government gives the CCEIC’s findings the gravitas they clearly merit. Such a refusal also risks the repeat of mistakes that led to avoidable harm to surrounding communities, the local environment and restoration liability, our shared climate, planning control, trust in the Local Planning Authority, and Wales’s reputation as a climate leader. We ask the Welsh Government to reconsider the relevance and urgency of reviewing the broader implications of the failures at Ffos-y-Fran and implement systemic changes to prevent similar issues in future, in-line with the CCEIC’s recommendation.

In the event that the water cannot be drained from the, voids at the site, Merthyr Tydfil County Borough Council must ensure that any, water bodies resulting from the restoration at Ffos-y-Fran are safe and provide, benefit to the local community.

Accepting this recommendation with no further comment will not reassure local communities, particularly given the lack of consultation to date, and unsafe conditions documented around the flooded voids at similar sites of Margam/Parc Slip and East Pit former opencast coal mines.

Merthyr Tydfil County Borough Council must ensure, that the revised restoration plan reflects, as a minimum, the objectives of the, original restoration plan, including: safe public access across the East Merthyr, historic landscape with a new network of trails and footpaths; sustainable, wildlife habitats and biodiverse environmental sites; protection and restoration, of surviving heritage features; and the return of most of the site for traditional, commoners’ use.

Any revised scheme would inevitably differ in that overburden mounds 2 and 3 are, likely to be retained and a body of water will be incorporated into the scheme. The developer has also, indicated that they would wish to retain the motorcross facility.

Allowing the void to flood and letting the site operator leave its colossal coal tips (overburden mounds) above ground amounts to an abandonment of the original restoration objectives promised to local communities. As with MTCBC’s refusal to issue a Stop Notice to prevent the daily illegal mining of over 1,000 tonnes of coal, allowing a noisy motocross to be atop one of those coal tips that operated during this period of unregulated illegal activity, would be seen as another betrayal of local communities to the benefit of the mining company.

Merthyr Tydfil County Borough Council should fully, involve local residents in the consideration of revised restoration plans for the, Ffos-y-Fran site.

We are disappointed at this glib and non-committal comment and invite MTCBC to properly respond to the CCEIC’s recommendation 24.

Merthyr Tydfil County Borough Council should publish, the application for the revised restoration plan at Ffos-y-Fran and the planning, officer’s associated reports

Merthyr Tydfil County Borough Council:

Response: Noted

Our analysis:

We are disappointed at this glib and non-committal comment and invite MTCBC to properly respond to the CCEIC’s recommendation 25.

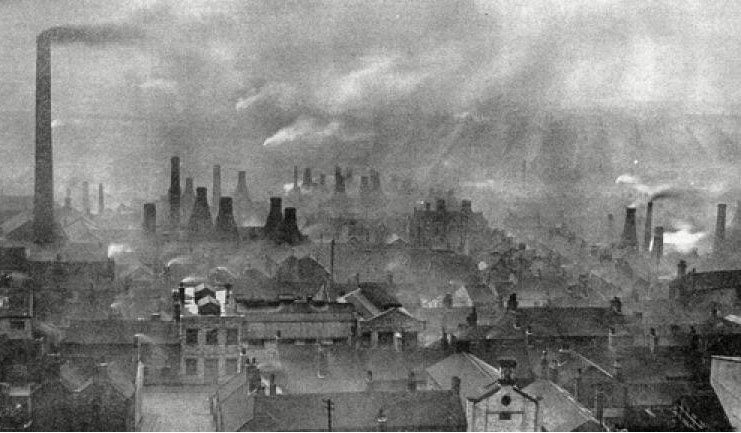

Smoke filled the sky across the industrial parts of the UK, as coal powered the industrial revolution. First coal brought prosperity and progress, but over decades the smoke stacks have been identified as a major cause of the climate crisis.

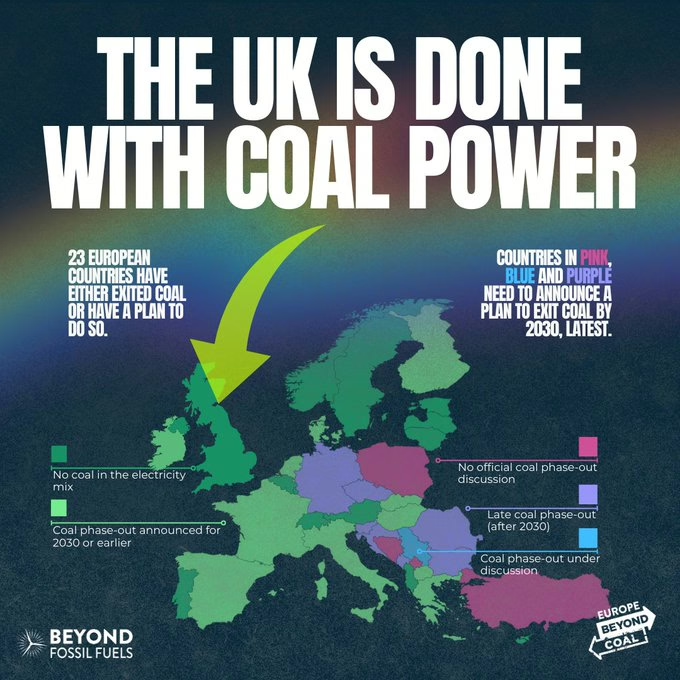

Over the last 20 years the UK has changed dramatically, with the closure of Ratcliffe on Soar power station at the end of September 2024, marking the beginning of a coal free era. As recently as 2012, coal provided 40% of the UK’s electricity, with around 40 coal mines extracting 17.1 million tonnes of coal, with an additional 45 million tonnes of coal imported from Russia, Colombia and the USA.

Ratcliffe on Soar, near Nottingham opened in 1967, with a capacity of 2,000 megawatts, enough to power 2 million homes. Since the early 2000s people across the UK have campaigned against coal power stations, coal mines and other coal infrastructure. Coal is the greatest historical cause of climate change and still a major global contributor of green house gas emissions.

In 2015, the UK was the first country to announce it would phase-out coal by 2025. While lauded as a big climate victory the Government’s intention was also to ensure coal didn’t exit the UK’s grid any earlier than 2025. At the time coal still contributed 9% of the UK’s electricity supply.[1]

Ratcliffe power station has seen its fair share of protests demanding closure. One example of direct action took place on the site in 2007, when Spring into Action, saw 11 people locked on to the dumper trucks and the conveyor belts, feeding coal to the power station. This caused major disruption to the plant operation, before they were removed. Back then Ratcliffe was the UK’s 3rd largest source of carbon dioxide emissions in the UK.

One of the group occupying the site said “the threat of climate change is so huge and the government so complacent that the people themselves are now acting in proportionate response to this and targeting the root causes of climate change.”

In a far cry from recent sentencing, in 2009, when 114 people were pre-emptively arrested from a meeting place in Nottingham, they were found to have been intending to occupy Ratcliffe for as long as possible. When activists were sentenced, one judge declared they acted with "the highest possible motives".i They accepted that they were intending to close the power station, but said that the urgency of climate change meant they had to take this action.

Undercover police officer Mark Kennedy, was involved in organising actions against Ratcliffe power station and as such some of the convictions were later overturned.

Three years ago, prior to the Glasgow COP climate summit, the phase-out date was brought forward to 2024. The UK wanted to be seen as a climate leader in phasing-out coal and setting up the Powering Past Coal Alliance with Canada in 2015, but others got there first.

Although the UK was first to announce the end of its coal power sector, Belgium was the first European nation to stop burning coal, ending its use in 2016. Sweden stopped using coal in 2019, bringing forward the planned date by 2 years. Austria stopped using coal in 2020. Neither the Belgium nor Austrian phase-outs were considered to be government driven.i Portugal brought forward its phase-out date twice from a starting point of 2030 to 2021.

The UK Government extended the life of coal power stations after Russia invaded Ukraine. Drax, West Burton and part of Ratcliffe coal power stations were kept from retiring in 2022, in a fear that Russian warmongering would endanger electricity supply. The UK stopped Russian coal imports in response to the war.

In 2017, the UK had sourced 49% of its imported coal from Russia, where coal mining contributed to cultural genocide and laid waste to large areas of the country, decimating rivers, forests and agricultural areas.

Imported coal comes with a high toll for the local populations and campaigners in the UK have been pushing for an end to imports of coal from Russia as well as Colombia, while calling for the end of its mining and use in the UK. Over the years London Mining Network has brought visitors to the UK from international coal affected regions, particularly in Latin America. Meeting these campaigners has been profoundly moving experiences for people living close to proposed coal mines in the UK, as the similarities in their struggles are numerous, and it shows that the campaigns are thinking globally by acting locally and pushing for the end of coal power.

The movement against coal power in the UK has been wide, with people standing up and saying no to opencast coal mines near their homes and joining together to stop 45 planned new opencast coal mines from operating. Significant battles were fought at Lodge House in Derbyshire, in the Pont Valley in Durham and Ffos-y-fran the UK’s largest opencast mine, which was allowed by the Welsh Government to mine coal for an unbelievable 15 months after planning permission ended.

Coal Action Network has worked with communities resisting opencast and later deep coal mining across the UK. From its inception in 2008, it has supported more than 25 communities to stop coal mines and extension from destroying local wildlife, filling local people’s lungs with dust and the industrialisation of the countryside.

Site occupations have been a significant tactic in slowing or stopping coal mines from starting. Coal Action Scotland occupied several sites including Mainshill and later Glentaggart East, both in South Lanarkshire for action camps that disrupted operations on existing opencast sites. Scotland’s last coal power station, Longannet closed in March 2016, and the Scottish Government banned coal mining in 2022, in a protest against the proposed West Cumbria coal mine.

In 2018 the last two opencast coal mines started, both in County Durham, opposition to the one in the Pont Valley a protest camp was set up and featured in the urgent film documentary Finite: the climate of change. This campaign, and others in the North East had brought the local opposition to coal extraction to a head and in 2020 the proposed mines at Druridge Bay, and Dewley Hill were rejected, along with an extension to the Pont Valley opencast. Support for coal had turned a corner.

With the coal-phase out announcement and pressure on opencast coal mines coal companies started saying that their coal was destined for use in the steel industry. The second and third biggest single site emitters of carbon in the UK were Port Talbot steelworks and the steelworks at Scunthorpe. Drax power station has the dubious honour of being the biggest carbon emitter, which although it no longer burning coal, it does burning trees from old growth forests.

In September 2024 the planning permission for the proposed West Cumbria coal mine was revoked and then the license from the Coal Authority was rejected. Communities in Cumbria and beyond fought long and hard to bring about these results which were cemented in court by South Lakes Action on Climate Change and Friends of the Earth.

[1] Digest of UK energy Statistics 2017, page 14

The UK is reaching a major milestone in its transition to clean energy, one that Coal Action Network has campaigned for since its inception in 2008 — the complete phase-out of coal power generation. From October 2024, Ratcliffe power station — the last remaining coal-fired power station in the country — will be permanently shuttered. It is a milestone that should be celebrated, and one that serves as an inspiration to other countries around the world to follow suit.

Coal has been a mainstay of the UK's power grid for over a century, both driven and sustained by British colonialism. At its peak in 1950, coal accounted for 97% of the UK's electricity generation. Since then, concerns over climate change and air pollution contributed to successive UK Governments pushing the world’s dirtiest fossil fuel out of the UK power mix.

Through a combination of policies, renewable technology alternatives, market forces, and public pressure, the UK has steadily reduced its reliance on coal power over the past decade. Measures such as the carbon price floor, restrictions on coal plant emissions, and the rapid growth of renewable energy sources like wind and solar have all contributed to coal's decline.

The phasing out of coal power entirely is a major victory for the environment and public health. Coal combustion is a major source of greenhouse gases, as well as harmful air pollutants like fine particulate matter, sulphur dioxide, and nitrogen oxides. By eliminating coal from the energy mix, the UK has taken a crucial step in reducing its carbon footprint and improving air quality.

Looking ahead, the challenge now is to ensure that the UK's energy system remains reliable and affordable as it continues to transition towards renewable sources. This will require significant investment in grid infrastructure, energy storage, and flexible generation capacity to balance the intermittency of wind and solar power.

Nevertheless, the end of coal power in the UK is a testament to the countless hours committed by both climate activists and local people who spent countless hours and risked their freedom campaigning to close the coal-fired power stations poisoning the air they breathe and trashing the climate we all rely upon. But the spectre of coal still looms with the UK continuing to mine and export coal abroad - in 2023 alone, UK exports of coal generated around 1.8 million tonnes of CO2. It is reckless and hypocritical to dump the dirtiest of fossil fuels on other countries whilst boasting that the UK itself has moved beyond coal.

Check out our current campaigns against ongoing coal mining operations in the UK.

Coal powered Britain’s industrial and economic expansion during its Industrial Revolution. The abundance of coal discovered in Britain was a key factor that enabled the country’s early industrialisation, developing technologies and industries unfeasible elsewhere due to the lack of cheap energy sources. The British Empire’s expansion was partly driven by the need for other resources and labour to fuel this industrial growth, leading to the exploitation of natural resources in colonised regions.

The demand for coal intensified as the British economy expanded, and the empire’s infrastructure, such as steam-powered railways and ships, was largely powered by coal. This infrastructure extended the empire’s colonial expansion and exploitation of resources.

The British Empire’s decline after World War II coincided with significant economic changes in the UK. As the empire contracted, the UK faced economic challenges that necessitated a shift in industrial focus. The coal industry, which had been a cornerstone of the British economy during the height of the empire, began to decline as the UK sought to modernise its economy and reduce reliance on traditional industries. As the empire declined, the UK faced increased competition from other countries that were industrialising and developing their own energy resources. This competition, combined with the high cost of domestic coal production, made coal less economically viable on the global market. These market conditions made it possible for Margaret Thatcher, then Prime Minister, to rapidly and infamously dismantle coal mining in the UK, closing 159 coal mines 1984-1994.

The Clean Air Act of 1950 and later environmental policies further accelerated the decline of coal. The “Dash for Gas” in the 1990s, driven by the repeal of restrictions on gas use in power stations, further reduced coal’s share in the energy mix. In the 2000s, improvements to battery storage, increasingly cheaper renewable energy technologies, and carbon credit schemes, made coal progressively uncompetitive and unnecessary.

The decline in coal mining in the UK and the slower decline of coal use means the UK became increasingly dependent on coal imports, often from former colonies and poorer regions of the world. The colonial dynamics of this was increasingly centred by activists in the UK in grassroots resistance to ongoing coal dependency. Activists highlighted that the UK’s continuing use of coal in the UK had a double effect of inflicting on the global south; off-shoring localised environmental damage and displacement from coal mining, and then the worst consequences of climate change that burning that coal would return to those communities. The widely publicised climate camps and grassroots campaigning helped shape an increasingly negative public perception of coal. This, together with declining reliance on coal, coincided with a new UK Labour Government policy in 2009 that any new coal-fired power station would need to be fitted with carbon capture and storage. This technology was so expensive and largely ineffective that it effectively deterred any proposals for new coal-fired power stations. With existing and ageing coal-fired power stations coming to the end of their operating lives over the 15 years that followed, and now no coal-fired prospects to replace them, the Conservative Government that inherited this decline set in motion by the previous Government’s policy, branded it a new climate commitment to remove coal from the UK’s energy mix by 2025, later brought forward to 2024.

That brings us to Ratcliffe-on-Soar, that UK’s last coal-fired power station, fated to close at the end of September 2024, ending an era of coal-fired power generation in the UK. Coal used for other industrial purposes such as steel manufacturing and cement production are also a focus of decarbonisation efforts and public subsidy. As the UK moves away from the coal it used to rely upon, existing coal mines in the UK – most notably Aberpergwm, which is licenced to operate until 2039 – would need to export its coal to maintain sales. This could risk returning to a colonial dynamic where the UK benefits from dumping resources on developing countries that are considered unfit to use domestically due to air pollution and other factors.

Published: 17. 09. 2024

Campaigners celebrate as the decision to allow a new coal mine in Cumbria is quashed.

Today, 13th September, South Lakes Action on Climate Change and Friends of the Earth won their case, against the Conservative Government's 2022 decision, to allow a new coal mine. Following a hearing in the High Court in July 2024.

Delighted campaigners gathered outside the former County Hall in Kendal and in Whitehaven Market Place to hear the news together this morning.

The Judge, Mr Justice Holgate ruled, "The assumption that the proposed mine would not produce a net increase in GHG emissions, or would be a net zero mine, is legally flawed"

The case was won on 4 out of 5 grounds and the Judge rubbished the mining company's claims the mine would have been net zero.

Maggie Mason, South Lakes Action on Climate Change said, "As ordinary responsible people, we saw this horrendous example of fossil fuel company arrogance, the weakness of our local government, we knew enough science to know the terrible impacts this would have on our beautiful planet and people, the poorest and most vulnerable first."

"We could not stand by and do nothing to prevent it. We needed to tell the truth, work hard and pitch in some money to get a legal team that understood the issues."

The following were ruled against the mining company.

Issue (i) – breach of the 2011 Regulations, (ii) – the substitution issue (iii) - Impact of granting planning permission on UK’s leadership role in promoting international action on climate change (iv) Arrangements for offsetting GHG emissions from the operation of the mine

Issue (v) – Unlawful disparity in the treatment of the parties’ cases - was not agreed.

This victory means that 60 million tonnes of coal and associated methane will likely be left underground. West Cumbria Mining Ltd, could appeal the decision. Angela Rayner, the Secretary of State for Housing, Communities and Local Government, needs to decide how to proceed now the decision has been returned to the Government.

The public consultation window for the National Policy and Planning Framework represents the first opportunity since the new UK Government was formed to stop any new coal mine application winning planning permission across England. This sweeping change would go a long way to ruling out any new coal mines in the country.

For the last year we have been working behind the scenes to persuade political parties to commit to banning new coal mines in the UK. Thanks to our work, 5 major parties in Parliament committed to this in their manifestos, including the new UK Government.

One of the first actions the new Government is taking is to reform the National Planning Policy Framework. Their main focus is on building more houses and renewable energy projects. But one part of the NPPF advises local planning authorities on whether they should grant permission to applications for more coal extraction. Currently, the guidance is vague which and open to expensive legal challenge from mining companies which can make planners wary to refusing permission to new coal mine applications.

We know new coal extraction must be stopped, and we want the UK Government to ensure that happens in this reform by providing the clear direction planners need to confidently say NO to new coal mine applications.

The Government is running an open consultation on their proposed reforms until September 24th. The more folks who write in, the harder it'll be for the UK Government to ignore your collective call to draw the line in the sand right here, right now. Help us end coal mining in England by using our form to respond.

ERI Ltd launched its pre-application consultation in early 2024 to mine two coal tips in Bedwas, South Wales. The company is proposing to extract a total of around 468,000 tonnes of coal from both tips. This would drive further climate chaos by over 1.3 million tonnes of CO2, as well as devastate the coal tips’ natural regeneration over the past 30 years since it was abandoned. The project also endangers the beautiful Sirhowy Valley Country Park bordering one of the tips. ERI Ltd claims it would use some of the profits from the coal mining to restore the coal tips afterwards. This amounts to more coal mining to clean up the mess left by old coal mining—we’ve been here before with the nearby Ffos-y-fran site, and we know it doesn’t end well.

Thousands of coal tips scatter the UK, but are concentrated in the former coal field areas - and 40% of coal tips are to be found in South Wales. Applications to mine coal tips of coal that was once discarded in the tips but has since become commercially valuable stretch back to at least 1984. We searched a single Local Planning Authority's planning portal within a former coalfield area in each nation of the UK, to provide a snapshot showing how established and widespread this industry practice is.

Wales

Scotland

England

With over 300 category D coal tips in South Wales alone, ERI Ltd’s proposal could trigger a new wave of coal mining if it were successful. For the sake of localised impacts and our collective climate, we are therefore committed to challenging an application by ERI Ltd every step of the way, together with the local community resistance, Sirhowy Valley Country Park support group, Good Law Project, Friends of the Earth Cymru, and Climate Cymru.

Regular safety monitoring is considered sufficient for most category D coal tips abandoned by the coal industry in South Wales. But for coal tips that pose a danger to nearby communities, more coal mining isn’t the solution—we need swift remediation sensitive to local ecologies and lives. These diverse fungi were spotted by a local resident on a single walk nearby the coal tips:

The Senedd’s Climate Change, Environment, and Infrastructure Committee (CCEIC) has released a critical report on the management of opencast coal mining in Wales, particularly focusing on Ffos-y-Fran, one of the last opencast coal mines in the region. The report describes Ffos-y-Fran as a “symbol of the system's failures”, highlighting significant shortcomings in oversight.

The CCEIC specifically calls out Merthyr Tydfil County Borough Council (MTCBC) for its inaction regarding illegal mining activities that continued after the mine's license expired in September 2022. The report questions whether MTCBC could have done more, noting the Coal Authority's concerns about the lack of a robust closure plan.

Local residents have expressed deep concerns about their treatment by public authorities. The committee emphasized the need for improved transparency and engagement, urging MTCBC to involve residents in the revised restoration plan.

Campaigner Chris Austin welcomed the report, stating it offers strong recommendations for policy changes regarding coal mine restoration. He expressed hope that the findings would lead to better outcomes for Ffos-y-Fran and prevent future issues.

We praise the CCEIC for investigating the failures that allowed illegal mining to occur without repercussions. The focus now must be on the Welsh Government and Merthyr Tydfil County Borough Council implementing the committee’s concrete recommendations to restore justice to affected communities.

Among the 26 recommendations (see below for a full list), the CCEIC calls for the Welsh Government to ensure that policies on opencast coal mining are robust and protective of local communities. The Coal Action Network advocates for a clear ban on coal mining in Wales, similar to Scotland's 2022 decision, to prevent mismanagement in the future.

The report serves as a crucial reminder of the need for accountability and proactive measures in managing natural resources in Wales.

Own emphasis

From Tuesday 16th July to lunchtime 18th July, Lord Holgate heard the case, brought by South Lakes Action on Climate Change and Friends of the Earth, against the Government’s 2022 approval of a new underground coal mine at Whitehaven.

In the preceding week the new Government accepted the decision of the former Government was legally flawed, and has conceded the legal challenges to the approval. A Barrister representing the new Secretary of State, Angela Rayner, was present on the request of the Judge, but made no submissions.

Demonstrations in support of the court case were held in Whitehaven on the evening before the case began and on the first day of the hearing. In London, there was a demonstration before the start of the case, outside the High Court and a meeting of Quakers at lunch on the second day.

Estelle Dehon KC of Cornerstone Barristers representing South Lakes Action on Climate Change and Friends of the Earth’s Barristers as to why the mine should not have been granted permission. This was based on the lack of consideration of emissions on use of the coal (the Finch case precident); errors in the Environmental Statement; the false argument that coal mined in the UK, means less mining abroad; failure to comply with the 6th carbon budget; and inconsistency of treatment of parties in the planning inquiry.

The Judge, Lord Holgate had ruled against Sarah Finch at the High Court, before she won her case in the Supreme Court. The Finch case law was much debated during the hearing looking at the Whitehaven coal mine. It states that emissions from the consumption of fossil fuels should be considered when deciding planning applications for new fossil fuel production.

Barrister James Stratchan KC for West Cumbria Mining Ltd set forth its case that the coal from Cumbria would perfectly substitute for more expensive coal from the USA so overall there is no increase in emissions. This assumes that coal mines with permission to be extracted coal in the USA would chose to leave the coal underground in an equal measure to it is extracted from this site. He tried to argue that as this coal was coking coal normally used in coal power stations, and as such it shouldn't be considered as a fossil fuel and therefore sought to avoid discussing the recent Finch victory.

Lord Holgate engaged in detail with the points put before him, but is not expected to deliver a decision until after some weeks of deliberation. If the case is upheld the decision would then be returned to the Secretary of State for a fresh decision, a process which is also likely to take weeks or months and involve another public inquiry, which may be limited in scope.

We will let you know when we have a decision to report on.