Carbon footprint

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting in the order of 4.1 billion tonnes CO2e (75% of which are direct emissions). This is largely due to the reliance on ‘coking’ coal in blast furnace primary steel production.

Coal-free steel pathways

Four of the five biggest global steel producers aim to reach carbon neutral steel production by 2050. This would be through a combination of using ‘electric arc furnaces’ (EAF) to recycle scrap steel into secondary steel products, and a newer technology called Direct Reduced Iron that replaces coal with natural gas or hydrogen in primary steel making. The hydrogen option could be generated from renewables but relies on the roll-out of much more renewable generation capacity and massive green hydrogen infrastructure, which has so far received little of the huge investment required. So where this new Direct Reduced Iron technology (also requiring significant investment) is being used, it’s generally with natural gas instead. Those steelworks could be switched to hydrogen in the future, if the price of green hydrogen drops to a competitive level and the infrastructure to get the hydrogen to steelworks is built.

Threats to coal-free steel decarbonisation

There is a global over-supply of steel, primarily generated by China which produced 54% of global output in 2023. This has reduced the price that steel can be sold for to the point that many steelworks are running at a loss, supported by government subsidies to continue operating. This threatens the very significant private sector investments needed into green steel production as the industry’s current position makes a profitable return on that investment unlikely. A blast furnace can continue for 15-20 years before undergoing a ‘relining’ (refurbishment) process to extend its life further. Relining can cost 25-50% of the cost of a new blast furnace, but still amount to hundreds of £millions. Due to the long life and large capital investments, it’s essential that investments now are in greener steel-making processes or the world will be ‘locked in’ to CO2-intensive steel-making for many years to come.

In 2024, UK steel production made up 32% of domestic consumption and was responsible for 13.4% of GHGs from manufacturing, and 2.2% of total UK greenhouse gas emissions. The vast majority of this footprint is due to the coal burned at Scunthorpe steelworks. With the UK Government rightly ruling out any new coal mining projects in the UK, it is vital that UK steelworks becomes coal-free. Switching domestic coal mining for coal mining abroad would perpetuate colonial patterns of trade where the impacts of extractive industries are off-shored.

UK primary steel-making is wholly dependent on imports for the two main resources needed to make steel: ‘coked’ coal and iron ore. Coal needs to be ‘cooked’ in ‘coking ovens’ before it becomes coked coal capable of burning at very high temperatures required in blast furnaces. The UK closed its last coking oven in Port Talbot in March 2024. Since then, UK primary steel-making has depended on other countries to process coal in coking ovens before being imported into the UK.

The UK’s largest steelworks, Tata Steel UK’s Port Talbot steelworks, recently closed its blast furnaces, which had come to the end of their operational life. With £500 million from the UK Government, Tata seized the opportunity to shift from making coal-based blast furnace primary steel to using electricity to recycle scrap steel into new secondary steel products instead.This technology is called an ‘electric arc furnace’ (EAF). Although the transition should have had more Union and worker involvement, the conversion to EAF is a pragmatic move given the UK’s scrap steel surplus, the financial losses being made in the blast furnace steel production, and the UK’s net-zero commitments. Four of the UK’s other steelworks also recycle scrap steel using EAFs. The fifth is British Steel’s Scunthorpe steelworks, which still produces coal-based primary steel, and so is the second biggest single site source of CO2 in the UK.

Scunthorpe’s blast furnace steelworks needs to decarbonise to remain competitive, improve local air quality, and avoid fuelling climate chaos. Before the UK Government took partial control of the steelworks around April 2025, the operators – Jingye Group – claimed financial losses of £700,000 per day. Additionally, customers – who will soon face mandatory carbon reporting – may increasingly choose to import lower carbon steel from other European countries like Sweden and Spain who are pursuing low-emission primary steel production. The current options for Scunthorpe steelworks are:

1) convert to Direct-Reduction Iron technology to produce primary steel

2) convert to recycling scrap steel in a EAF to produce secondary steel products.

Producing secondary steel option would be much cheaper, but politically difficult as it would mean the loss of many jobs and the loss of the UK’s primary steel-making capacity. Find out more about the technology options below:

Read more about coal in steel in our 2021 report.

Blast furnace primary steel production: Metallurgical-grade coals converted to ‘coke’ which has a dual role in a blast-furnace, providing the required heat and creating a chemical reaction with iron ore reducing it to ‘pig’ iron which is heated with other additives (including small quantities of existing scrap steel) to make steel.

Electric arc furnace secondary steel production uses 99% less coal than blast furnaces per tonne of steel produced by using electricity to melt down scrap steel to make secondary steel products, with small quantities of coal added to remove certain impurities. In countries, such as the UK, which generates a large share of its electricity through renewables, EAFs have a much smaller carbon footprint than blast furnace steel production. The UK currently produces a surplus of scrap steel, exporting it to EAFs abroad. Having greater EAF capacity in the UK will keep the scrap here, and the jobs it supports. Steel is – in theory – an endlessly recyclable product, but when it’s fused with other metals and materials, or has other properties added to it, it can be challenging to recycle it in EAFs into high-grade metals needed for certain applications, even with small quantities of coal added to remove certain impurities.

Direct reduced iron (DRI) primary steel production: is an emerging alternative to blast furnaces where natural gas or hydrogen replaces the role of coal in heating and reducing high-grade iron ore down to iron, ready for primary steel-making in an electric arc furnace. There are successful commercial test-cases for this technology, such as HyBrit in Sweden which uses hydro-generated green hydrogen to make steel. However, green hydrogen is prohibitively expensive, currently, so DRI facilities tend to use natural gas whilst being “hydrogen ready”. DRI production also makes capture rates for CCS much higher than a blast furnace.

It is vital that the forthcoming UK Government’s green public procurement policy for construction and Carbon Border Adjustment Mechanism should be sufficiently robust so as to support UK low-emission steel to compete with cheaper higher emission steel imports. Together, this should add confidence within the British steel sector that the UK Government’s public procurement pipeline will be a pipeline that supports domestic industry.

The UK Government must take action to secure the UK’s production of virtually coal-free secondary steel-making:

The UK Government’s steel safeguard Tariff Rate Quota expires in June 2026 – but the UK’s Carbon Border Adjustment Mechanism is not expected to be implemented until 2027. The UK Government should introduce stop-gap measures to prevent high-carbon steel imports causing carbon-leaking and undermining investment to produce greener steel in the UK.

The UK Government should engage in honest conversations now with unions and workers at the loss-making Scunthorpe Steel Works regarding the future of steel-making at the site. EAFs are currently the only financially viable technology to replace the coal-fed blast furnaces currently in operation. That would result in job losses but this can be a just transition with enough time to allow for proper planning, union and worker involvement, and funding. This should be followed with a commitment to add DRI primary steel production by mid-2035 as the technology and green hydrogen are expected to become more financially viable.

Coal Action Network is proud to present our 2026 manifesto for Wales. With the Senedd elections taking place in May this year, Wales stands at a decisive moment. For over a century, coal has shaped Welsh landscapes, communities, and politics. Today, Wales has the opportunity to shape something very different…

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

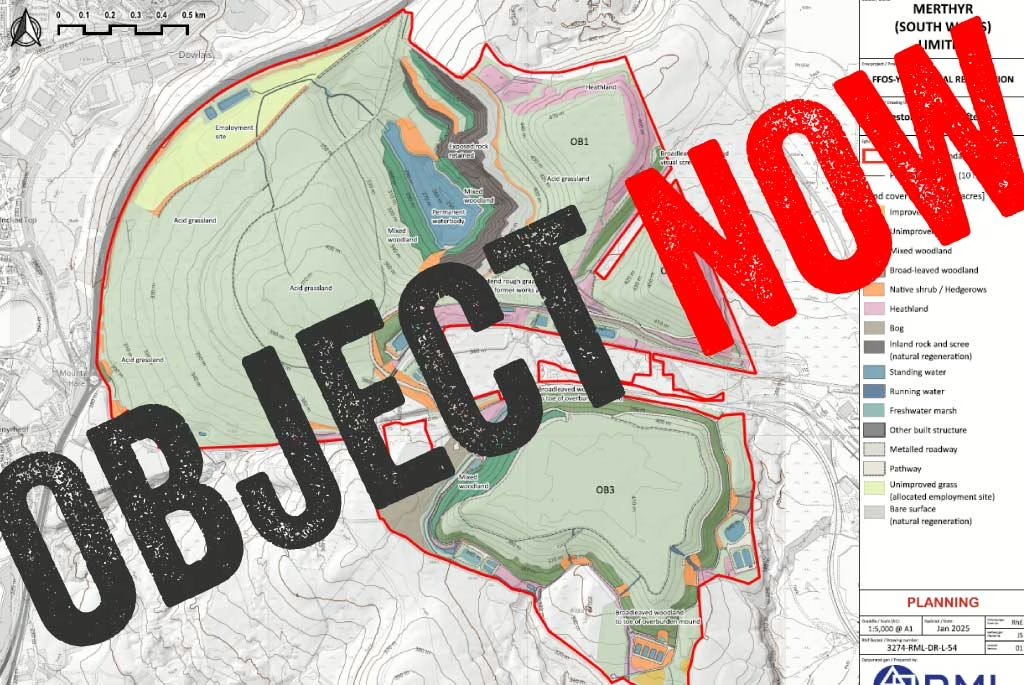

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…