Reposted from original press release by Insure our Future

Utilities are struggling to find insurance to build new coal power outside China, finds a report released today by the Insure Our Future campaign and Korean non-profit Solutions for Our Climate, which have obtained documents providing a rare snapshot of the state of the industry.

The insurance contracts for KEPCO, Korea’s national power utility, also reveal that it is having to turn to smaller, inexperienced companies to secure cover for coal power plants that are already in operation as growing numbers of mainstream insurers withdraw from the sector.

“Major international insurers have withdrawn from coal projects and been replaced by a haphazard coalition of the willing, consisting of a few global climate laggards, small speciality insurers and assorted companies from the Global South. Our report exposes Starr, Liberty Mutual, Berkshire Hathaway, Allied World and Lloyd's of London as the coal industry’s last lifeline."

- Peter Bosshard Global Coordinator of the Insure Our Future Campaign and report author

Since the Insure Our Future campaign launched in 2017 at least 39 insurers have ended or limited their cover for new coal projects. However, the report confirms that even prominent international brands like Hannover Re (Germany), SCOR (France), QBE (Australia) and Helvetia (Switzerland) continue to underwrite existing coal plants, supporting companies like KEPCO that have no plans to phase out coal in line with climate targets.

Coal is the biggest single source of carbon emissions. To stay on track for the 1.5°C Paris Agreement climate target, consumption of coal must fall by 9.5% per year.1 No investment in new fossil fuel production is consistent with that target, according to the International Energy Agency, yet it warns that coal demand could reach all-time highs in 2022 and stay at that level until 2024.2

The insurance industry is under growing pressure to align its policies with 1.5°C. UN Secretary General Antonio Guterres told the Insurance Development Forum last year: “We need net zero commitments to cover your underwriting portfolios, and this should include the underwriting of coal – and all fossil fuels!”3

Asia is at the centre of global coal power generation and development, accounting for 91% of all plants planned or in construction worldwide (414GW out of 457GW) and 73% of operating coal plants (1,518GW out of 2075GW).4 KEPCO is a major player, developing and operating coal power projects in several Asian countries and arranging insurance on the global market.

In March 2018, KEPCO signed contracts with 19 insurers to underwrite the construction of the 1.3GW Nghi Son 2 plant in Vietnam for a total $7.2 billion. Four years on, 72% of the insurance capacity which underwrote that project has been withdrawn from the market.

“It is now unlikely that large new coal power plants outside China can be insured. The withdrawal of so many insurers has made it much more cumbersome and expensive to obtain cover. The few insurers who remain will find it challenging to provide the vast expertise and capacity required to insure a complex new coal power plant.”

- Peter Bosshard

The Insure Our Future report, EXPOSED: The Coal Insurers of Last Resort, analyses documents provided by the Office of Korean National Assembly Member Soyoung Lee, which give details of insurance contracts for five KEPCO coal power projects. Governments, insurers and insurance brokers do not normally disclose information about which companies insure which projects, so it presents a unique insight into the withdrawal of insurers from the world’s leading coal market.

When KEPCO insured the construction of Nghi Son 2 in March 2018, most international insurers had yet to adopt coal exit policies. The project was underwritten by numerous large multiline and speciality insurers and reinsurers, led by Germany’s Allianz with $1.1 billion.

By October 2021, when KEPCO insured the construction of the 1.2GW Vung Ang 2 plant in Vietnam for a total $4.4 billion, most large international insurers had withdrawn from the coal market. Asian insurers provided 55% of total capacity, led by Japan’s MS&AD with $1.2 billion of cover, North American insurers provided 38% and European insurers 7%.

Half (53%) of the insurance capacity provided to Vung Ang in October 2021 has now been withdrawn from the market with MS&AD, Sompo and Tokio Marine in Japan, Hiscox in the UK and AIG in the US announcing that they will no longer insure new coal projects. China also announced in September 2021 that it will no longer build coal power projects overseas and Chinese insurers are expected to exit the international market.

Five “insurers of last resort” now provide 72% of the capacity for Vung Ang 2 which is still available for new coal projects: US companies Starr, Berkshire Hathaway and Liberty Mutual (the only insurer with a coal exit policy that allows it to continue covering new projects); Allied World in Bermuda; and eight other insurers operating in the Lloyd’s market. 5

Lloyd’s of London insurers, which include Allied World and two Liberty Mutual subsidiaries, now provide 37% of the capacity still available to the market. In December 2020, Lloyd’s ruled out insuring new coal projects from 2022 but has since made clear that it will not require insurers in its market to follow the policy.

"These findings make clear that the Lloyd's market, Starr, Liberty Mutual, Berkshire Hathaway and Allied World are the world’s coal insurers of last resort. At a time when we urgently need to accelerate the transition away from fossil fuels, their reckless support for new coal projects drives us ever closer to unmanageable climate breakdown."

The replacement of large, experienced international insurers with a wide variety of smaller actors also affects the operation of existing coal power plants. In June 2021, KEPCO had to find 24 different insurers to provide $556 million of cover for the operation of its small 206MW Cebu Naga power plant in the Philippines. Eleven were not insuring any other KEPCO projects and one, New India Insurance, lacks the A-credit rating that project financiers typically expect insurers to provide.

Global insurance broker Willis Towers Watson warned as early as January 2019 that “the exodus of many international insurers from the market for coal risks complicates securing property coverage” and “this reduction in available capacity will invariably see upward pressure on rates and coverages.” 6

However, the report also shows that many insurers with coal exit policies are continuing to provide cover for companies such as KEPCO that have no credible plans to phase out coal production. They include leading brands Hannover Re, which only plans to phase out insurance for the biggest coal companies by 2025, SCOR and QBE, which have a 2030 target, and Helvetia, which has no phase-out target.

“KEPCO and other power utilities need to rapidly phase out their coal power fleets in line with global climate targets, and insurance companies should stop insuring power utilities which have no credible phase-out plans. Power utilities and their insurers need to urgently move beyond a pathway which is projected to take the planet to a catastrophic 2.7°C of global warming by the end of the century.”

Only 37% of OECD coal power capacity (100GW) is scheduled to close by 2030 and 6% of non-OECD capacity (100GW) by 2050. 7

The report says that for insurers to align with the Paris target they must:

1 One Earth Climate Model, Sectoral Pathways to Net-Zero Emissions, 18-5-22

2 IEA, Coal power’s sharp rebound is taking it to a new record in 2021, threatening net zero goals, 17-12-21

3 UN, Secretary-General’s closing remarks to Insurance Development Forum, 18-6-21

4 Global Energy Monitor, Global Coal Plant Tracker: Coal-fired Power Capacity By Region, January 2022

5 Beazley, Chaucer, Canopius, Markel, Antares, Cincinnati, AEGIS and W.R. Berkley.

6 Willis Towers Watson, Ready and Waiting? Power and Renewable Energy Market Review 2019

7 Global Energy Monitor, Boom and Bust Coal, April 2022

Read the full report here

Coal Action Network is proud to present our 2026 manifesto for Wales. With the Senedd elections taking place in May this year, Wales stands at a decisive moment. For over a century, coal has shaped Welsh landscapes, communities, and politics. Today, Wales has the opportunity to shape something very different…

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

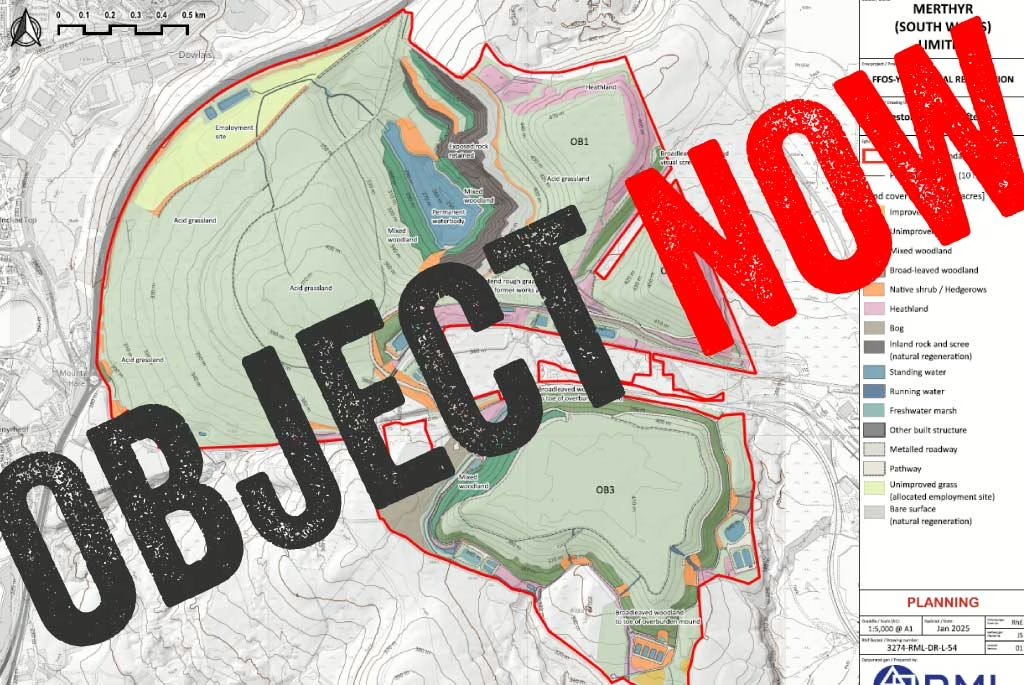

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…