Our 2026 Wales manifesto

February 19th 2026

Coal Action Network is proud to present our 2026 manifesto for Wales. With the Senedd elections taking place in May this year, Wales stands at a decisive moment. For over a century, coal has shaped Welsh landscapes, communities, and politics. Today, Wales has the opportunity to shape something very different…

Lee Anderson on dirty, horrible, dangerous coal jobs

January 28th 2026

As part of our Politics Unspun series we are unpacking politicians’ public comments on coal to challenge any misleading or incorrect messages. Todays’ focus is on comments made during a Westminster Hall debate in December 2025 about the oil refining sector. During the debate, Lee Anderson MP made some statements about coal…

Take Action – End new English coal

January 27th 2026

The Government is reforming planning policy in England and thanks to thousands of our supporters asking for an end to coal extraction in the last consultation in 2024, they are now recommending that planners “should not identify new sites or extensions to existing sites for peat or coal extraction”…

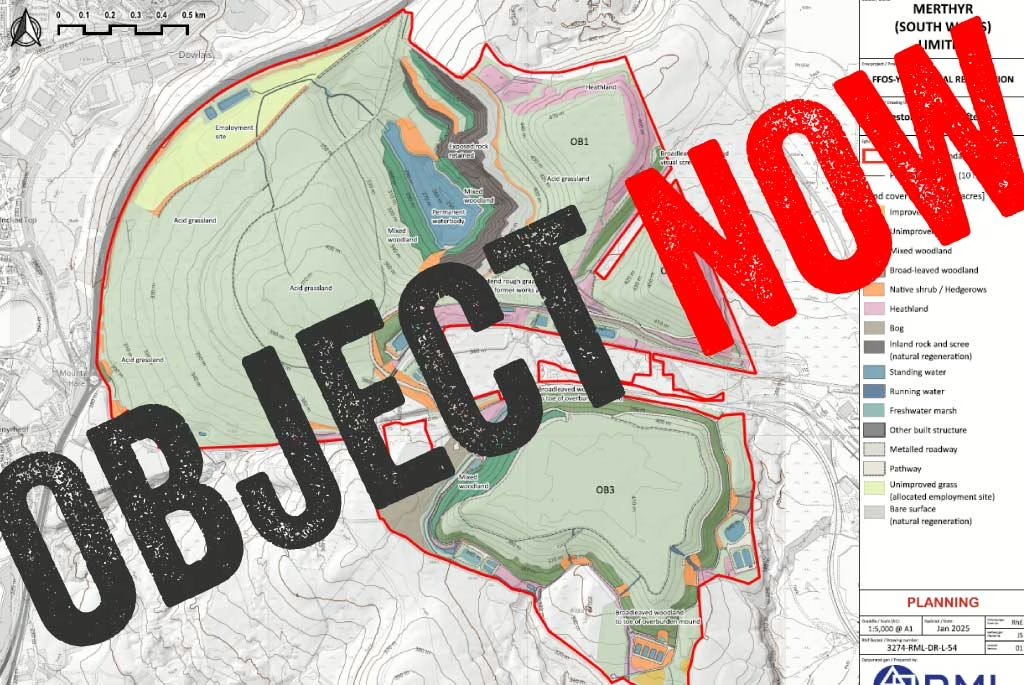

Demand nature be restored to Ffos-y-fran opencast site

January 9th 2026

Merthyr (South Wales) Ltd mined for over a year illegally after planning permission for the Ffos-y-fran opencast coal mine ended in September 2022. During that year, it made record-breaking profits due to sanctions on Russia and other factors driving up the price of coal. But rather than using some of the profits from that ill-gotten coal…

2026 must be the year that new coal extraction will be banned

December 3rd 2025

In November 2024, the new UK Government announced its intention to legislate a ban of new coal mining licences – which we welcomed. Over a year later, the legislation is yet to be introduced, and the Government is not planning to include all types of extraction…

Where our coal comes from

November 21st 2025

The UK steel and cement sectors (and to a lesser extent, bricks) are the largest users of coal following the closing down of the UK’s last coal-fired power station in September 2024. Check out our coal dashboard for our most recent coal stats including an industry break-down. We support the UK Government’s commitment to ban…

A stainless future for steel

November 12th 2025

The steel industry produces 9-11% of the annual CO2 emitted globally, contributing significantly to climate change. In 2024, on average, every tonne of steel produced led to the emission of 2.2 tonnes of CO2e (scope 1, 2, and 3). Globally in 2024, 1,886 million tonnes (Mt) of steel were produced, emitting…

Westminster Hall debate – Coal tip safety & the coal licence ban

November 6th 2025

Last month we worked with Members of Parliament from various parties on a Westminster Hall debate about coal tip safety and the prohibition of new coal extraction licences. The debate happened 59 years and one day after the Aberfan tragedy which killed 116 children and 28 adults…

Concrete opportunities for coal-free cement works

October 29th 2025

Successful, at-scale, examples already exist of cement works burning 100% fuel alternatives to traditional fossil fuels, including pilot projects using combinations of hydrogen and biomass (UK) and hydrogen and electricity (Sweden). Yet, innovations such as use of hydrogen and kiln electrification are…